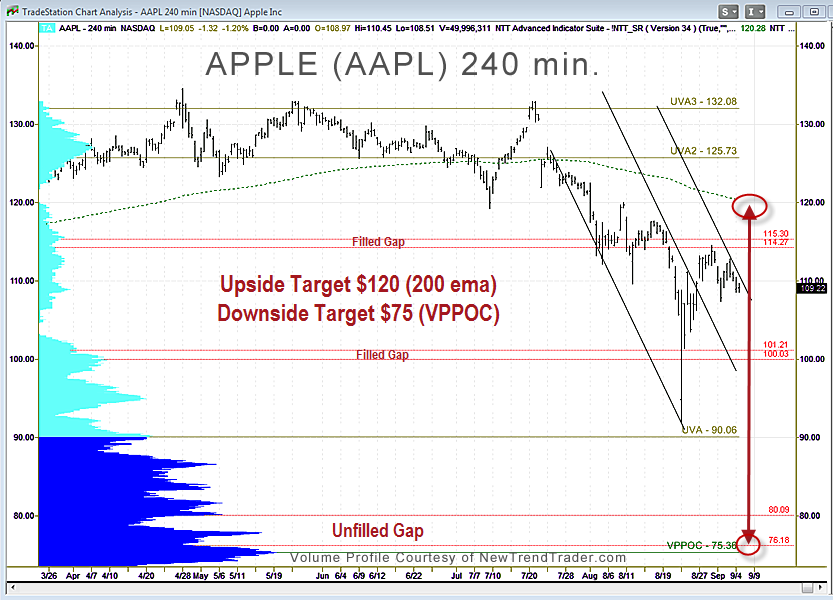

On August 7 and again on August 16, I noted that Apple shares had risk to $100, an unfilled gap zone. On 8/24 AAPL closed that gap and tested its long-term Upper Value Area (UVA) boundary around $90. The UVA, where the cyan and blue lines intersect on the accompanying chart, is one standard deviation above the Volume Profile Point of Control (VPPOC), the level at which the most volume was traded during the 3.5-year look-back period.

The good news for Apple lovers is that market participants definitely perceived value around the UVA zone and aggressively bought shares. Price then consolidated at the end of the month, leaving Apple in no-man’s land, just below a secondary downtrend line.

Since the primary downtrend has been broken, AAPL is in technical limbo. The upside target is the 200-day ema at $120. The downside target is the VPPOC itself at $75, which coincides with a very large unfilled gap. Which direction AAPL heads first is likely to be news-dependent. The ultimate target, however, is $75.

If you would like to receive a primer on using Volume Profile, please click here.