SHORT-TERM (today and 5 days out)

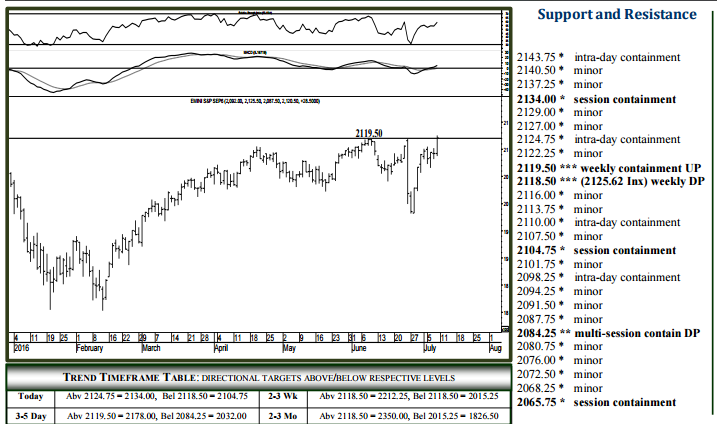

For Monday, the 2118.50-19.50 region can absorb selling through the balance of Q3, above which 2212.25 is now considered a 3-5 week target, 2350.00 attainable by the end of the year. Upside today, 2124.75 can contain initial strength, while pushing/opening above 2124.75 indicates 2134.00 intraday, able to contain session strength. Closing above 2134.00 indicates 2178.00 within 3-5 days where the market should top out on a weekly basis. Downside Monday, breaking/opening below 2118.50 signals 2110.00, likely to contain initial selling, below which 2104.75 becomes an intraday target able to contain session weakness. Breaking (especially opening) below 2104.75 allows 2084.25 intraday, able to contain selling into later week and a meaningful downside continuation point over the same time horizon.

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2118.50 region (2125.62 Index – page 2) can absorb selling into later year, above which 2212.25 is now considered a 3-5 week target, 2350.00 attainable by the end of the year. Upside, 2212.25 should contain monthly buying pressures when tested, with a settlement above 2212.25 maintaining an accelerated upside pace into Q4, 2350.00 then expected over the following 5-8 weeks where the market can top out well into 2017. Downside, a daily settlement back below 2118.50 allows 2015.25 within several weeks, able to contain selling through August activity and the level to settle below for indicating a good Q3 high, 1826.50 then becoming a 3-5 week objective able to contain selling through 2017.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE