The wheat market has been unable to keep pace with the soybean and corn rallies. In fact, as corn and beans moved higher from April through June, wheat fell to new lows. The actions taken by both the speculators and the commercial traders on the recent trend extension to new lows is telling. We’ll examine this behavior and explain why wheat may finally be due for a bounce.

We use the weekly Commitments of Traders report to determine who is doing the buying and selling within the market we’re watching. It’s our experience that market prices typically reflect the general trend of the actions taken by those who are intimately involved with the commodity’s production or, consumption. Collectively, no one knows their market better than this group of specialists whose living is tied directly to the correct prognostication of a single market. Furthermore, we balance this approach by tracking the speculators’ actions as well. History and data, have shown that the speculators tend to get caught with their biggest positions at the most inopportune moments. We calculate the tension between these two groups in the chart below and use it to forecast turning points based on speculative exhaustion and commercial value.

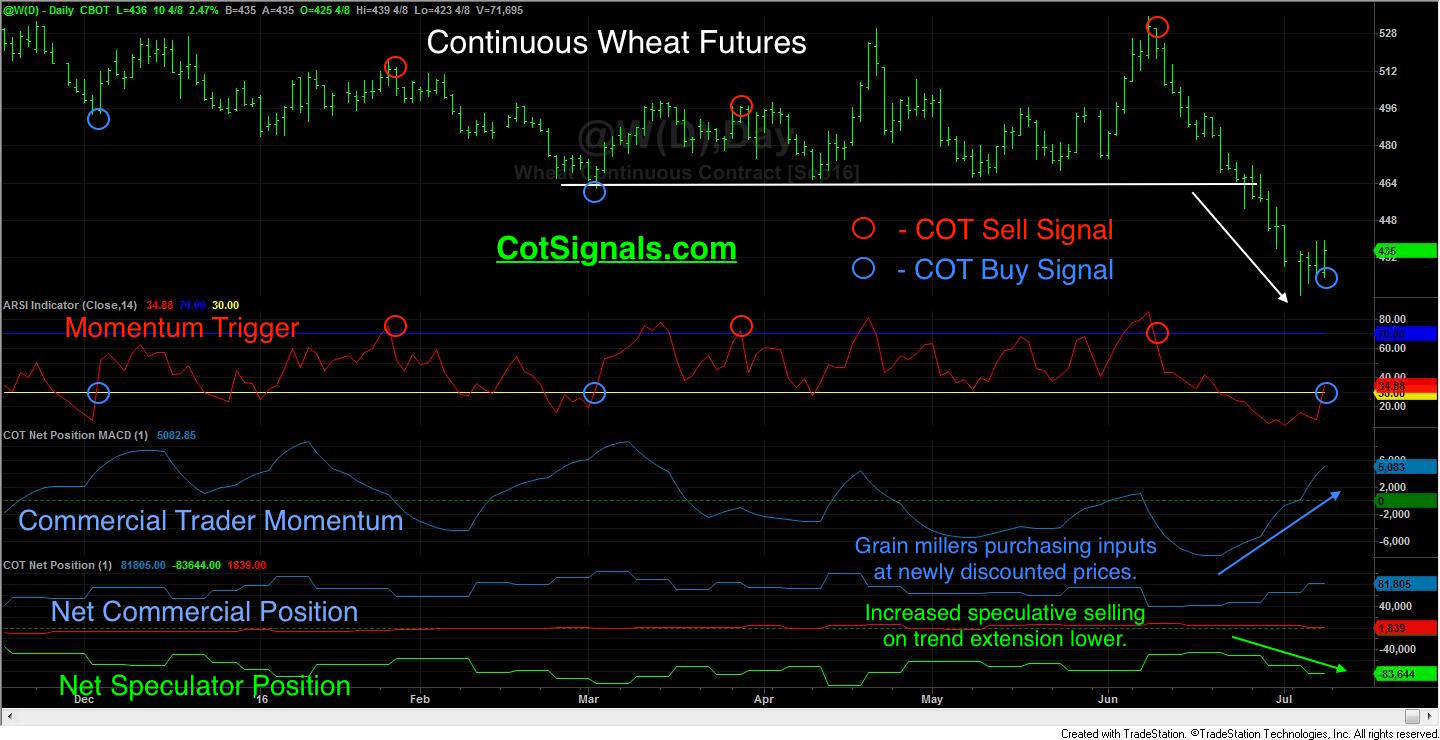

In the generally sideways market conditions that persisted through June of this year, you can see that commercial traders are small buyers on the declines and small sellers on the rallies. This reflects the value proposition of the individual companies selling forward production on rallies and buying inventory on declines. We track tension created as a combination of commercial trader momentum and versus speculative trader momentum in the momentum trigger and use the reversals to trigger the swing trades highlighted below.

The move to new lows under the support at $4.64 provides a real-time example of the opposing trading methodologies between commercial traders and speculators. Notice the speculative net selling in each of the last three weeks as the market moves to new lows. This is indicative of two types of speculator actions. First, the fall through support has triggered stop loss selling by bottom picking speculators. Second, trend following speculators will have added to their positions or, created new short positions on the move to new lows. Both of these options create net sellers. The first group locking in losses and the second group selling the market in the hole.

The commercial traders on the other hand have shown up to buy the market at the new value driven prices. This allows grain millers and end line wheat consumers to lay in forward supplies without having to load up on the physical commodities and storage. The commercial buying represents a mean reversion methodology whereby the current prices reflect a relative value compared to recent prices. Meanwhile, the speculators’ actions are purely trend following and the move to new lows indicates further weakness ahead.

This is where the market battles are fought. Trend trading versus mean reversion trading and commercial assertion of fundamental supply and demand versus trend following speculation. Our current bet is on the collective side of the commercial wheat users and their assumption that the recent lows are a buying opportunity in the short-term.

For more information on how we apply the Commitments of Traders data in a swing trading methodology, please visit CotSignals.com.