Unusual Options Activity

On April 1st, 7,100+ Apr $8 calls traded with the majority purchased for $0.25-$0.60. Prior to this action, the $8 calls already had the largest open interest in the April options expiration. Call activity was 6x the average daily volume, as implied volatility soared 52.4% to 137.44. The jump in IV is significant since it brings the expected move through April options expiration to $1.70, up or down.

Fundamentals

On March 5th, Arrowhead Research acquired Novartis’ RNAi R&D portfolio for $35M in cash/stock with potential royalties. On top of this recent deal, the $407M biotech company with more than $127M in cash and short-term investments also has a lot riding on its Hepatitis B drug, ARC-520, which is currently in Phase 2 clinical study. There are an estimated 2M in the U.S. and 14M in Western Europe that have this liver infection. On March 5th, Zacks Investment Research maintained an outperform rating and a $15 price target. Back in the fall of 2014, shares were more than cut in half, but on October 8th, Jefferies said the selloff was unwarranted and reiterated their $30 price target.

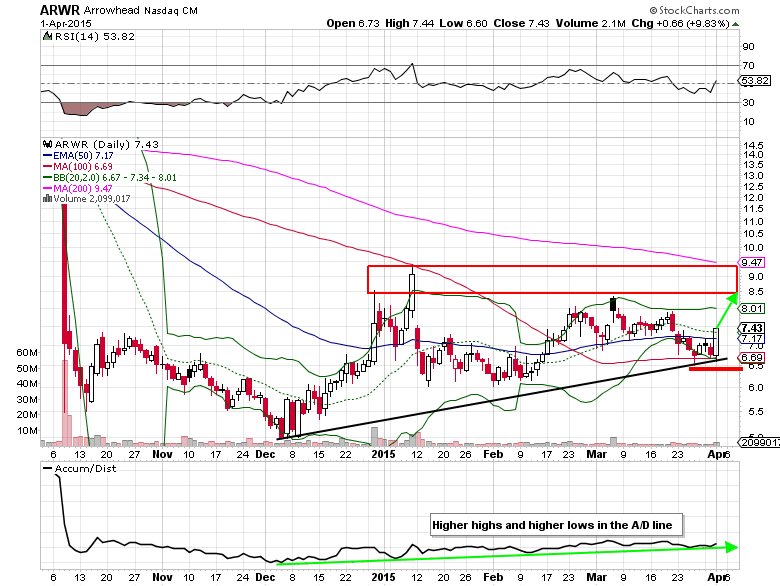

Shares of ARWR printed a bullish engulfing candlestick on heavy volume after testing the 100-day SMA. This type of price action sets up for additional gains in the coming weeks, possibly back into the intermediate-term resistance range of $8.50-$9.33. Stop losses on long stock positions can be placed under the March low of $6.50 just in case the latest correction has more to go.

Arrowhead Research Options Trade Idea

- Buy the May $7/$10 bull call spread for $1.25 or better

- (Buy the May $7 call and sell the May $10 call, all in one trade)

- Stop loss- $0.60

- 1st upside target- $2.00

- 2nd upside target- $2.90

Notes: This May bull call-spread gives you a lower breakeven point and four more weeks of time to play out.

#####

To read Mitchell’s “Unusual Options Activity Report Featuring Put Selling In CVS” at OptionsRiskManagement.com, please click here.