I am not sure what to think today, as the news is, well, both conflicting and seemingly positive overall, but, and still, the market is not happy. US manufacturing came in at a five-month high, but the ADP employment report missed its target; yet the manufacturing report from Markit also pointed out that US manufacturers are hiring (even as the ISM report showed manufacturing at a 22-month low). Yes, manufacturing employment is a small part of the US economy, but, nevertheless …

What about the “sluggishness” in small business hiring, you might ask? An article on Bloomberg this morning pointed out the following.

- Their payroll growth [small businesses] accelerated to almost 57,000 in March, bringing the first-quarter average to about 48,900, according to seasonally adjusted ADP data released today. That compares with about 54,700 in all of 2014.

The point is that the small, small businesses (less than 20 employees) are hiring less folks, right? Well, maybe that is true for the Q1 of 2015, but we already know that winter hit hard everywhere in the US, so, the numbers there are understandable.

So, as always, let’s take a look at the larger picture, you know the one that does not scrutinize a small piece of data, a snapshot if you will.

- Growth has slowed in some indexes measuring employment at companies with fewer than 20 workers. This deceleration indicates a disconnect in the labor market; payrolls for all nonfarm employers rose at the fastest pace since 2001 in the 12 months through February, based on Labor Department data.

So, overall employment is rising, and at a rate that is quite consistent and strong.

- The unemployment rate has fallen dramatically since the financial crisis, and is now at 5.5%. The February employment report was the 12th straight month the economy added more than 200,000 jobs, the best streak since 1995.

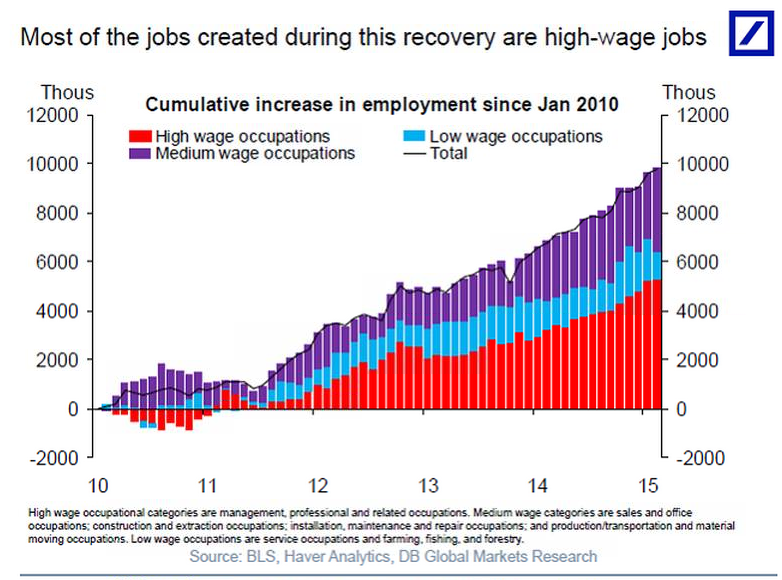

Yes, but the job growth is low-wage stuff, not really helping the economy, right? This is certainly what the breathless media and all of its mouthpieces have been telling us, but is it true? Like so many things in the media, the slant and pervasive push of the “news” creates impressions that are not always, well, accurate, to be kind.

A new report from Deutsche Bank (a reputable source, right?), suggests that the above is not only not true, it is, in fact, misleading, to be kind. Take a look at this chart.

Yet, here we are, a market heading south again, as the reality of the US economy is distorted by the myopia of the breathless media.

As to oil (Did you think I would not mention it?) …

- The cartel’s struggle for market share isn’t going so well.

The line above tells a story about a gamble the Saudis have taken – to curb US oil production to protect their market share. The seeming climax to this story is the utter failure of the Saudis to stop the growth of US oil production and, in the process losing market share dramatically.

- America’s oil in storage just hit another record after rising for the 12th consecutive week.

- America is the world’s biggest oil customer, and OPEC is losing its business—fast. U.S. imports of oil and petroleum products from OPEC have fallen to a 28-year low.

Okay, so the Saudis might soon recognize this reality and begin to cut production to offset this and to stem the decline in the price of oil, but it might be too late. It might be that Iran is recognizing its own reality and will accept some kind of agreement that will release its oil on the market, which will change the current inventory to one that favors a further decline in prices.

- Deputy Foreign Minister Abbas Araghchi, suggested his nation showed new flexibility over the easing of United Nations sanctions, an issue that’s been an impediment to a deal.

Granted, it will take time for Iran to ramp back up to full production, but don’t forget, they have some 30-million barrels pumped and stored on cargo ships ready for delivery at whatever price it can fetch.

Trade in the day; invest in your life …