Shares of the Japanese automaker, Toyota Motor (TM), are down 6.10% year to date. The stock trades at a P/E ratio of 9.18x (2015 estimates) with 8.62% EPS growth, 0.2% revenue growth, P/S ratio of 0.72x, 2.21% dividend yield, and has an average analyst price target of $127. On Tuesday, June 2nd, Toyota Motor reported that U.S. May vehicle sales were up 17%. Of the 243,236 units sold last month, Camry, Corolla, and Prius vehicles drove the sales increase. 4Runner, third to Highlander and Sienna in the SUV category, sales rose 70% to 7,550 units. This was the best monthly performance for Toyota Motor since 2008.

Unusual Options Activity

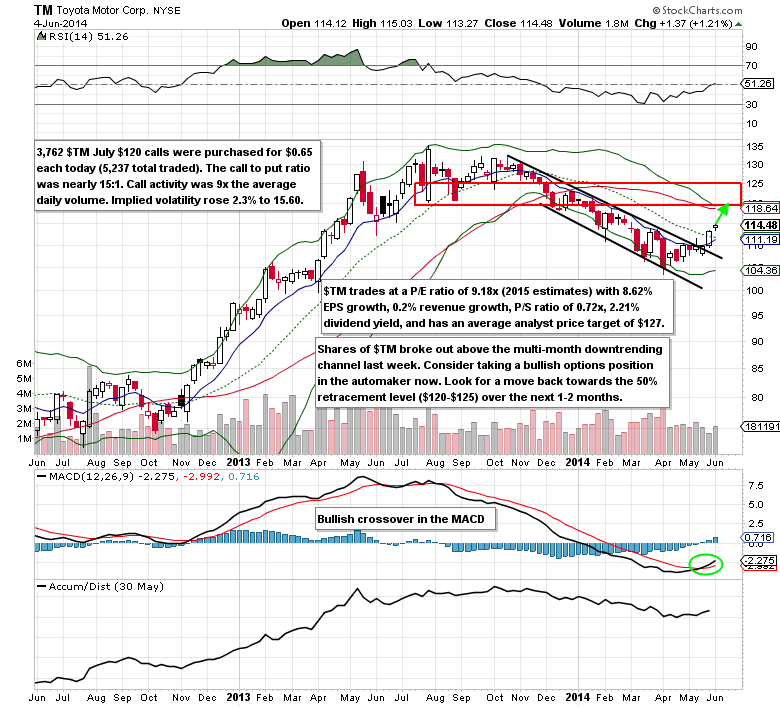

3,762 July $120 calls were purchased for $0.65 each on the day after the U.S. May sales came out (5,237 total traded). This trader is making a $250K+ bet that the stock will be at least $120.65 on July options expiration. The call to put ratio was nearly 15:1. Call activity was nine times the average daily volume. Implied volatility rose 2.3% to 15.60.

Technical Analysis

Shares of Toyota Motor broke out above the multi-month downtrending channel last week. Look for this trend reversal to take the stock back to the $120-$125 range over the next 1-2 months (roughly a 50% retracement). The moving average convergence divergence (MACD) secondary indicator is also confirming the breakout (see the chart).

Toyota Motor Options Trade Idea

Buy the July $115 call for $2.35 or better

Stop loss- None

First upside target- $5.00

Second upside target- $7.50

Disclosure: I’m long the July $115 calls for $2.26 each.

= = =