The S&P500 mini-futures (ES) continued to swoon Monday after the Chinese stock market took another knockout punch from panicky investors, many of whom are using borrowed money to bet that the central government will not allow the stock market to sink.

The Shanghai composite index rose 68% from February to June; it has since given back about 70% of that increase, and now stands about 20% higher than it was at the start of the year.

A 20% gain is worth having, but Chinese investors may not have it long. The Chinese government has adopted tactics ranging from direct purchases of stocks (the government now owns about 10% of the total market) to threats of criminal prosecution of “malicious sellers.” Nothing is working, and the Shanghai comp dropped about 8% before our market opened Monday morning. It was the worst single day performance since 2007.

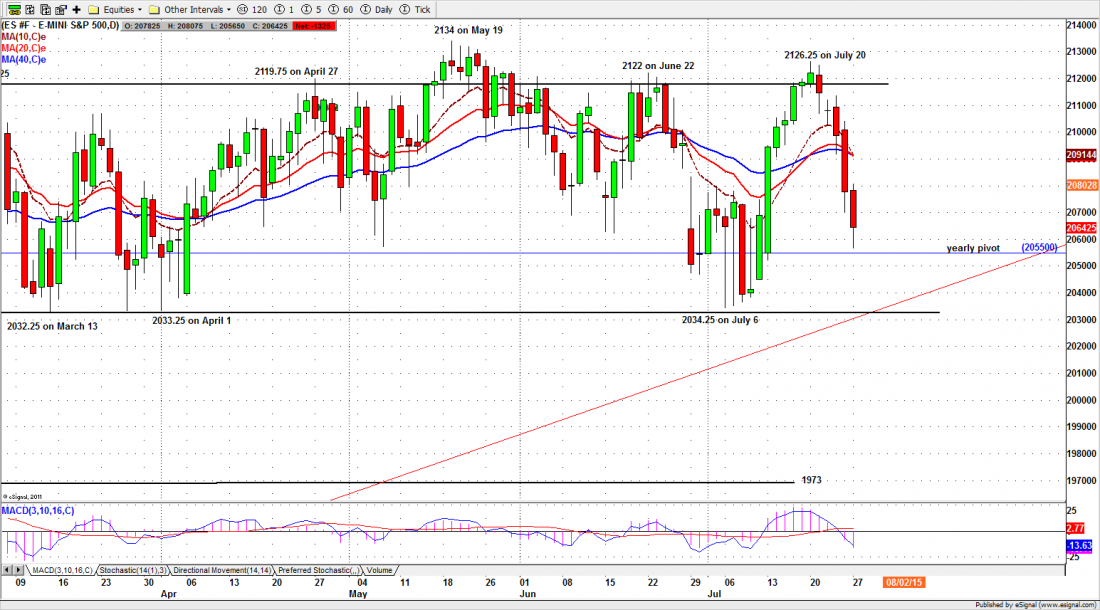

The effect on the US large-cap index was immediate. The futures (ESU5) gapped down at the open and never came back above Friday’s low. They spent most of the day near our yearly pivot at 2055, but managed a dead cat bounce to close at 2064.50, 13 points below Friday’s close. Ouch.

Today

On the daily chart (below) the 20-day moving average has moved below the 40-day ema. That’s a first selling signal, but we haven’t seen it confirmed yet.

Today the 2069.50-2070.50 zone will be a key area. A move above that area could lead the ES back up to fill the air pocket around 2080.75-2078.50. Remaining below it will probably lead to a repeat of yesterday’s regular hours trading range and a struggle to go lower. And the week is just beginning.

Major support levels for Tuesday: 2054-55, 2035-32, 2025-23.50, 2018.50-16.50;

major resistance levels: 2128.50-29.50, 2134.50-36.50

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: S&P500 mini-futures (ESU5) July 27, 2015