It’s always fun finding a stock with bullish fundamentals and technicals ahead of earnings. Akamai Technologies (AKAM) is in that boat now.

Earnings are due Wednesday after the close. A bullish setup doesn’t always guarantee success for a stock, but Akamai’s recent price action tells me the market’s expecting a solid quarter.

THE NUMBERS

The Thomson Reuters consensus estimate is for earnings of $0.50 a share, up 11% from a year ago. Sales are seen rising 18% to $381.1 million. Akamai isn’t growth as fast as it once was, but demand remains strong for the company’s products and services. In the prior three quarters, sales growth accelerated from 16% to 20% to 23%.

Akamai provides content delivery network services to media and entertainment companies. Its technology helps Web sites speed up the delivery of video and other content to viewers.

On December 6, shares popped 10% after the company announced a strategic alliance with AT&T to distribute content delivery network (CDN) solutions to AT&T customers.

The company also continues to make inroads in new business areas like Web security, network carrier products and cloud computing.

Short interest has been steadily declining in Akamai. At the end of October, 8.7 million shares were held short. As of January 15, short interest stood at 5.6 million shares.

Wall Street firms are flush with cash and feeling more confident about the economy which means 2013 could be a year of increased merger and acquisition activity. Akamai is no stranger to takeover speculation. It’s quieted down in recent months, but Google (GOOG), IBM (IBM) and Verizon Communications (VZ) have been mentioned in the past as possible suitors.

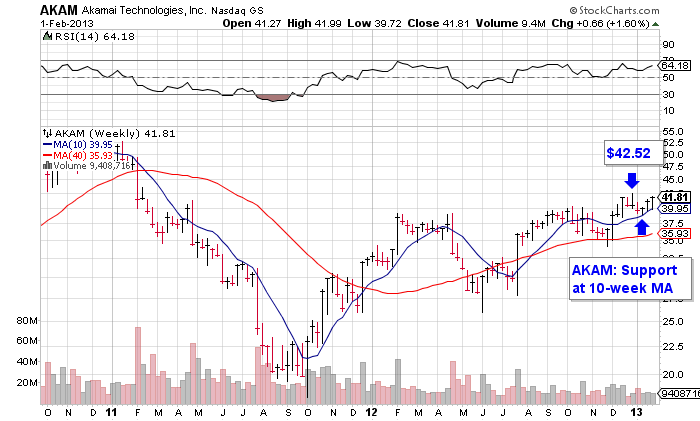

THE CHART

Akamai’s current technical setup brings a breakout over $42.52 into play. Selling pressure in the stock has been muted at best and the stock recently showed good supporting action at its 10-week moving average.

Shares of Akamai outperformed Friday, rising 2.7% to $41.81. There was some conviction behind the buying as volume totaled 2.8 million shares. It normally trades about 2.5 million shares a day.

= = =