Over the past few years we have argued that the markets have tended to push the energy and metals theme over the first half of the year before swinging back to ‘left behind’ themes through the second half. This has not been a text book kind of year so today’s initial chart exploration may be for naught but… we were wondering today whether the airlines might take a run through the final quarter.

To start off with we are going to lay out a bit of ground work. At top right is a chart comparison between AMR and the sum of the U.S. 30-year T-Bond futures and the U.S. Dollar Index (DXY) futures from 1987 into 1990 while below right is the same comparison for the time frame between mid-1996 and the end of 1998.

The premise is that the airline stocks- we are using AMR to represent this theme- have had two rather concentrated upward price trends. The first occurred after the stock market crash in 1987 leading to a peak around the start of the fourth quarter of 1989. The second began in early 1997 culminating in a price top in 1998.

The simplest way to do this might be through a comparison of AMR and the CRB Index. Commodity prices peaked in 1988 which helped rotate money into non-commodity themes. The commodity trend turned lower as well around the start of 1997 as energy prices and the commodity currencies turned lower. This trend ran through into 1998’s Asian crisis which set the lows for copper and crude oil early in 1999.

Instead of using the CRB Index we have opted to go with the bond market and dollar. In general a strong bond market and dollar will tend to go with downward pressure on copper and crude oil futures prices.

The charts show that one of the key features of the two rising trends for AMR was a concurrent upward trend in the sum of the TBonds and U.S. Dollar Index. The problem with the current situation is that we only have ‘one half’ of the equation working in the right direction as the bond market lifts in price even as the dollar weakens.

To make the case for the airline sector as we shift into the fourth quarter of 2010 we would likely have to see ongoing strength in the bond market and a return to a rising trend for the dollar. That may be something of a stretch but we thought we would at least show how this has worked during previous cycles.

Equity/Bond Markets

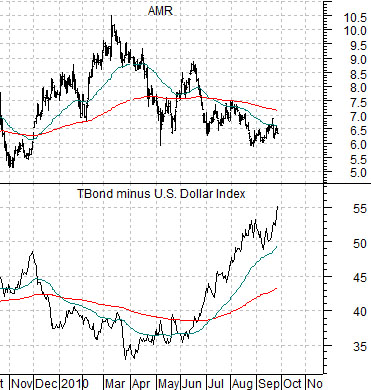

At top right we show the current situation for AMR when compared to the sum of the U.S. 30-year T-Bond futures and U.S. Dollar Index.

The chart shows that bond market price strength has been a positive even as dollar weakness has served as something of a negative. Fair enough.

Below is a different spin on the same theme. Instead of combining the TBonds and dollar we are showing the spread between the two. In other words the chart compares the share price of AMR with the spread or difference between the TBond futures and the U.S. Dollar Index.

This perspective helps to show that the negative trend for AMR began back in the spring when the bond market started to firm in relation to the dollar. If new quarters tend to lead to new trends then one thing to watch out for is a return to dollar strength which would help put pressure on commodity prices. If the bond market were to weaken as the dollar moved higher the spread would turn lower to the possible benefit of AMR. We should note that the rising spread between the TBond and dollar is positive for gold prices so one way to gauge the potential for AMR would be through offsetting gold price weakness.

So… why are we showing a relationship that simply hasn’t worked? To explain we have included a chart of AMR and the ratio between crude oil futures and the CRB Index at bottom right.

IF the crude oil/CRB Index is making a rather large ‘top’ then AMR is likely making a similar and offsetting ‘bottom’. When crude oil prices are strong relative to the CRB Index the airlines tend to suffer as cyclical growth shows up mainly through rising energy prices. Our view is that the airlines have been working through a rather protracted bottom for the past two years which is why we tend to return to this theme each time a new quarter is set to begin.