One definition of insanity is repeating a behavior while expecting a different outcome. We are not sure whether this applies to the markets but- just for the fun of it- this will be our opening topic today. Kind of an ‘first this then that’ proposition.

At the end of last week the Canadian dollar closed sharply lower, the Australian dollar moved upwards, and crude oil futures fell a couple of points. Canadian dollar weakness, Aussie dollar strength, and lower energy prices.

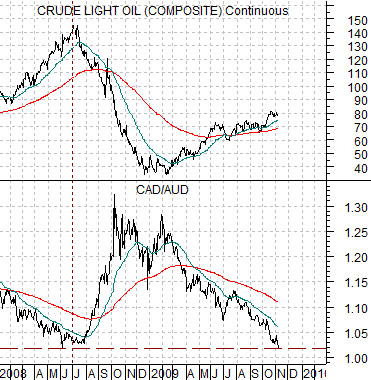

At top right we show crude oil futures and the cross rate between the Canadian and Australian dollar futures (CAD/AUD). The last time the cross rate fell to current levels was just ahead of the peak for energy prices in mid-2008. The markets have, in effect, taken the Canadian dollar back to the same levels relative to the Aussie dollar that marked the start of a sharp decline in energy prices this year. Is it rational to assume that this time is different?

At bottom right we have included a comparison between the share price of Intel (INTC) and the ratio between a Canadian bank (Bank of Nova Scotia- BNS) and a Japanese bank (Mitsubishi UFJ- MTU).

From 2002 into 2003 the ratio between BNS and MTU rose sharply as the share price of Intel wallowed below the 20 level. When the ratio reached its peak in late April of 2003 the share price of Intel had risen back to around 20. Over the next two quarters the ratio declined as INTC marched up towards 35.

The situation today is quite similar to 2003. The BNS/MTU ratio has pushed back to a peak helped in part by the kind of commodity price strength that drives the Cdn dollar while slowing the flow of money towards the tech sector. In almost identical fashion the share price of Intel has recently risen back to the 20 level after trading below it as the BNS/MTU ratio moved upwards.

Our point is that if history were to repeat in a ‘first this and then that’ kind of way then a cycle bottom for the CAD/AUD ratio would go with a peak for crude oil prices, a rising trend would go with energy price weakness, and weakness in the Canadian banks relative to the Japanese banks would confirm that the chip stocks (Intel) were in the midst of a rally that could conceivably take Intel all the way back up to the 35 level.

At right is a comparison between the ratio of the major oils (XOI) to the broad U.S. equity market (SPX) and the ratio of an energy user cyclical (Ford) to energy prices (heating oil futures).

The ongoing argument has been that the recovery should be led or driven by a rising Ford/heating oil ratio with periodic corrections marked by relative strength in the oil stocks. In other words… a return to a declining trend for the XOI/SPX ratio is viewed as a positive especially if it leads to new highs for the F/heating oil ratio.

Nov. 9 (Bloomberg) — India may be among the first Group of 20 nations to begin winding back fiscal stimulus after Prime Minister Manmohan Singh said faster economic growth would allow the measures to be withdrawn.

Below are two charts of copper futures. This comparison has so many ramifications that we suspect that it may well turn out to be our next chart fixation.

Copper prices peaked at the start of 1995 leading to a rising trend for bond prices. While copper prices last reached a high in the spring of 2006 the bond market did not begin to swing upwards until the summer of 2007. As a result we have lined the copper chart from January of 1995 up with copper futures in July of 2007.

What stands out is the similarity between the recovery in copper prices from July of 1996 through June of 1997 and the push upwards this year. If history were to repeat the cyclical commodity-driven trend would come to an end as we complete the current quarter before returning to a negative trend that would extend through into the second half of 2011.

We included the Bloomberg comment with regard to India above because it fits rather nicely with this perspective. As countries withdraw fiscal stimulus and the shock of near-0% interest rates fades it is entirely conceivable that economic growth will begin to slow.