Nov. 5 (Bloomberg) — Crude oil fell on speculation that a government report tomorrow will show that the U.S. unemployment rate climbed last month, depressing demand for energy products.

Whether crude oil futures prices declined in front of today’s employment report or behind the reality of Wednesday’s energy inventory data (at first blush the decline in inventories appeared bullish for crude oil but at second glance… it was somewhat disappointing as distillate demand failed to improve) is open to debate. From our point of view, however, the trend within the markets made a subtle and welcome shift yesterday.

At top right is a comparison between the ratio of equities (SPX) to commodities (CRB Index) and the sum of the price of the U.S. 30-year T-Bond futures and U.S. Dollar Index.

The argument is that even though the equity markets have been nicely higher this year the improvement has largely been as a result of stronger commodity prices. In other words… From November of 2008 to November of 2009 the equity/commodity ratio has been flat to lower.

The equity markets can rally with commodity prices but it makes for a nervous trend dependant upon the daily swings in the U.S. dollar. A stronger dollar weakens commodity prices which, in turn, adds pressure to the equity markets. A better and more sustainable trend tends to evolve out of a rising equity/commodity ratio but in order for that to happen the combination of the price of long-term Treasuries and the U.S. Dollar Index has to push upwards. As it has moved lower this year down the trading channel the equity/commodity ratio has held below the highs set last December.

At bottom right is a comparison between the U.S. 10-year T-Note futures and the ratio of the S&P 500 Index to crude oil futures. The quick point here is that when the SPX/crude oil ratio is declining there is downward pressure on bond prices and downward pressure on bond prices tends to be a negative for equities. Ideally both the SPX/crude oil ratio AND the sum of the TBonds and U.S. Dollar Index hold at the lows set in early June and then resolve higher. This would swing the equity/commodity ratio upwards and effectively remove some of the pressure that we have been facing in the long end of the Treasury market since the end of September.

Equity/Bond Markets

Nov. 5 (Bloomberg) — Soybean prices had their biggest drop in almost five weeks and corn dropped on speculation that U.S. farmers will accelerate harvests delayed by excessive rainfall.

We have a very simple macro-oriented view on the grains markets. Corn futures tend to peak on the continuous chart around the end of the second quarter. If prices rise above the mid-year highs before year end then we are positive on the grains until the following summer. That has not happened so far this year.

The fertilizer companies tend to trend with grains prices. In a strong grains price trend the share prices of Potash (POT) and Agrium (AGU) tend to rise quite nicely. With the sum of corn and soybean futures prices still declining from the highs set in June we have little interest in being positive on POT.

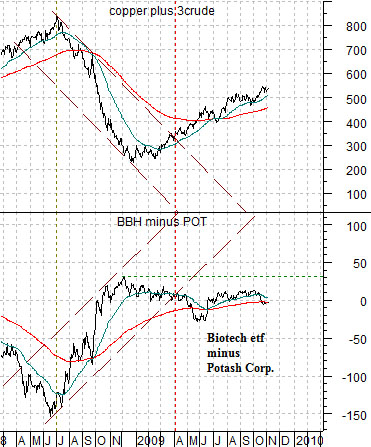

Below we compare the sum of copper and crude oil futures with the spread or price difference between the biotech holdrs (BBH) and Potash. In general a strong commodity price trend that pushes copper and crude oil prices upwards will tend to go with relative weakness in the biotechs. What we would like to see is a return to strength in the biotech space (more on pages 3 and 5) to mark the end of the 12-month rising trend for commodity prices.

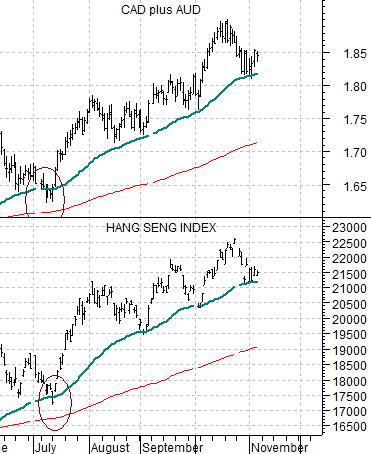

At bottom right we show a comparison between the sum of the Canadian and Australian dollar futures (two of the so-called commodity currencies) and Hong Kong’s Hang Seng Index. Both are still trending higher finding support again and again on the 50-day exponential moving average line. To break the trend the Hang Seng Index would have to decline back below 21000 confirmed by weakness in the commodity currencies.