Strange things can happen within the various cyclical sectors once copper has reached a relative strength peak. It may be that copper pushes on to higher highs in due course but given that the ratio between copper and the CRB Index has generally been weaker since the start of this year we thought we would run with this argument today.

In recent issues we have pussy-footed around the idea that the markets seem to be responding somewhat bullishly to the earnings of widely detested stocks and bearishly to the results from the obvious favorites. SuperValu, for example, gapped higher while Google, Alcoa, and even Goldman Sachs weakened following the release of quarterly earnings.

While there may any number of stocks more disliked that Cisco and Intel (although Cisco has to be near the top of the list of companies that portfolio managers would rather not show that they were long) these were the two names that we were focusing on. The idea was that both have been in year-long price down trends and there has been a bit of a tendency here and there for stocks to make bottom almost exactly one year after the last price peak.

DOW JONES NEWSWIRES: Intel Corp.’s (INTC) first-quarter earnings rose 29%, blowing past analysts’ estimates, as the chip-making giant’s revenue rose by one-fourth. The company also forecast current-quarter revenue of $12.3 billion to $13.3 billion. Analysts surveyed by Thomson Reuters expect $11.87 billion. Shares jumped 6% to $21.05 after hours. As of the close, the stock had fallen 17% the past year.

In May of 2006 copper reached an absolute and relative price high so we have included two charts at right from 2006. The top chart shows airline AMR selling off as copper prices weakened into the summer of that year before swinging upwards after the share price had fallen below the 200-day e.m.a.

Cisco had a similar chart that year as the stock price moved below the moving average line in July only to ‘gap’ back above the line following the release of earnings in August.

If Intel were to follow a similar recovery path now that the cyclical focus has started to shift away from base metals prices then it should punch sharply up through its 200-day e.m.a. line almost immediately.

The reason that we have been focusing so hard on names such as Intel and Johnson and Johnson is that eventually the U.S. dollar will bottom and start to rise. If the dollar strengthens solely because risk-based trades are being unwound then dollar strength is going to be bearish. If, on the other hand, the dollar begins to recover as a result of capital deciding that there are better growth opportunities within the large cap U.S. market then… dollar strength could easily be bullish.

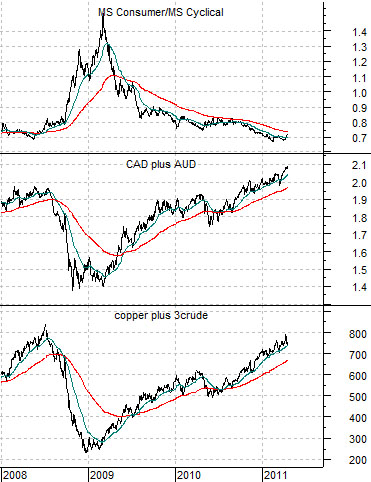

Below is a comparison between the ratio of the Morgan Stanley Consumer and Cyclical indices, the sum of the Canadian and Australian dollar futures, and the sum of copper futures (in cents) and crude oil futures (in dollars times 3).

To make this as simple as possible we are showing two sides of the same trend. Copper and crude oil rise as the commodity currencies strengthen. As long as copper and crude oil push higher money will move away from the U.S. dollar towards the currencies of countries like Canada and Australia.

On the other hand the strong commodity trend tends to go with a falling consumer/cyclical ratio. The problem is… the consumer/cyclical ratio has actually been rising over the past while.

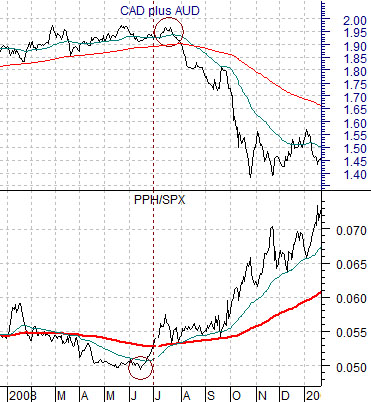

Below is a chart from 2008. The chart compares the sum of the CAD and AUD with the ratio between the Pharma holdrs (PPH) and the S&P 500 Index. Keep in mind that JNJ is a fairly major component of the PPH.

The chart shows that about a month before the commodity currencies collapsed in 2008 the PPH/SPX ratio began to rise.

The chart below shows the same comparison for the current time period and it makes the case that as long as the PPH/SPX ratio stalls in its advance at its 200-day e.m.a. line then the commodity price rally can continue.