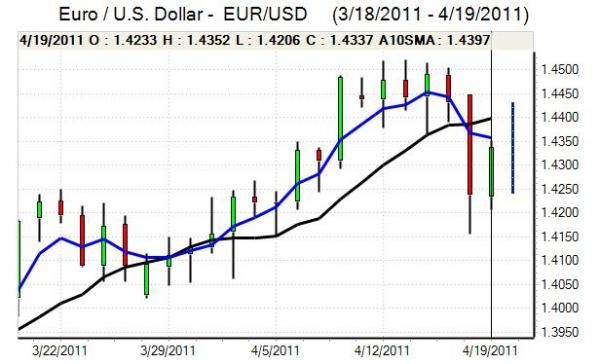

EUR/USD

The Euro found support on dips towards 1.4220 against the dollar on Tuesday and rallied steadily during the day with a peak just above the 1.44 level in Asian trading on Wednesday. Risk conditions recovered from the sharp setback seen early in the week with fresh gains in commodity prices and high-yield assets which undermined demand for the US currency.

The US housing data recorded an increase in starts to an annual rate of 0.55mn for March from 0.53mn previously and there was a stronger increase in building permits, but the overall impact on interest-rate futures and the dollar was limited.

Medium-term Federal Reserve policies remained an important market focus and there were further expectations that the Fed would maintain a very accommodative policy following the end of the current quantitative easing scheme. Nevertheless, the ending of the bond-buying programme will still provide important potential stresses to the markets and volatility will be an important feature.

The Euro-zone PMI data was solid according to the latest flash readings, although there was some slowdown in the services sector. There were further expectations that the ECB would look to increase interest rates late in the second quarter which maintained yield support for the Euro.

There were still important structural vulnerabilities within the Euro area as speculation over a Greek restructuring continued. There were also fresh doubts whether Spain would be able to de-couple from the weaker peripheral economies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 82.40 against the yen during Tuesday and there was a strong advance during Asian trading on Wednesday with a peak just above 83.0.

Defensive demand for the Japanese currency was weaker following a recovery in equity prices and easing of global risk aversion. There was also greater confidence in the US Treasury market following fears triggered the previous day by Standard & Poor’s decision to put the US credit rating on negative watch. Sentiment is still liable to shift rapidly given volatility in capital flows.

The seasonally-adjusted Japanese surplus declined to JPY0.10trn for March from JPY0.48trn the previous month as exports were undermined by the earthquake impact. The impact on market sentiment should be limited, but there will be some impact in lessening dollar supply from exporters which will provide some underlying support to the US currency.

Sterling

Sterling found support below 1.6250 against the dollar during Tuesday and moved steadily higher during the European session, primarily due to a fresh weakening in the US currency, with the Euro rallying back to above 0.88 against the UK currency.

There were no major UK incentives during the day with attention still focussed on global developments. There are persistent fears surrounding the Euro-zone structural vulnerabilities and the UK currency is still being seen as a safe-haven from the persistent Euro stresses. There will, however, still be unease over banking-sector developments, especially with very important exposures to Euro-zone loans and sentiment could shift rapidly.

The Bank of England minutes from April’s interest-rate decision will be released on Wednesday and the most likely outcome is that the divisions seen in March persisted at the April meeting. There is the possibility of sharper rhetoric surrounding inflation which could provide some near-term Sterling support, especially as expectations surrounding a May rate increase have faded sharply.

Swiss franc

The dollar found support on dips to below 0.8950 against the franc during Tuesday, but was unable to make a break above the 0.90 level. Franc moves on the crosses remained very important with the Swiss currency losing ground against the Euro with a move to the 1.2925 area.

There was some reported corporate demand for the Euro against the franc and there was also an easing of franc demand on defensive grounds as risk appetite improved during the session with fresh demand for commodity-related and high-yield assets. Volatility is likely to remain a key short-term feature in the franc crosses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

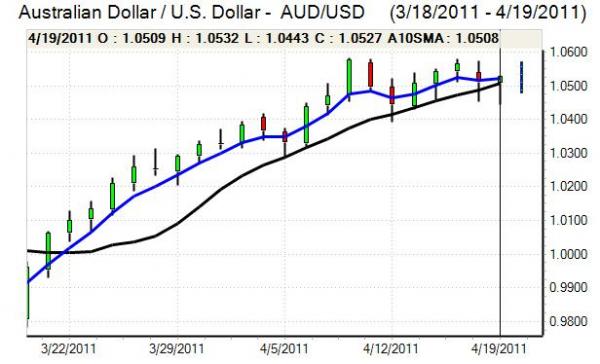

Australian dollar

The Australian dollar found support on dips to below 1.0450 against the US currency on Tuesday and after advancing steadily, there was a push to fresh 29-year highs close to 1.06 during Asian trading on Wednesday.

Risk conditions remained extremely important for Australian dollar sentiment and there was fresh demand for the currency as equity markets rallied and commodity prices found fresh support with gold at a record high. Volatility is liable to remain higher in the short term and the currency will continue to be supported by strong buying support on dips.