Our sense is that a number of key markets- including and perhaps especially the U.S. dollar- are setting up to ‘swing’ around the completion of this month’s Federal Open Market Committee meeting. With the Fed’s statement due following the end of the meeting on January 27th we have just under two weeks to get a number of arguments and explanations in order. Today, however, we are going to tread water somewhat as we explore a somewhat contrived chart comparison.

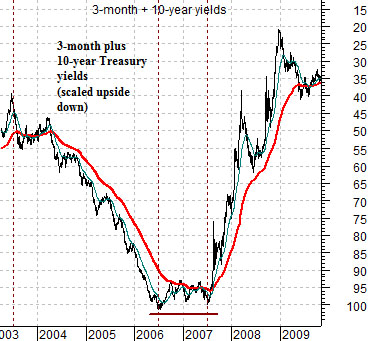

Below is a chart of the sum of short-term (3-month) and long-term (30-year) Treasury yields. The chart is scaled upside down for two reasons. First, because we often mistake confusion with accuracy and second, because we wanted the trend to go in the same direction as the chart below right.

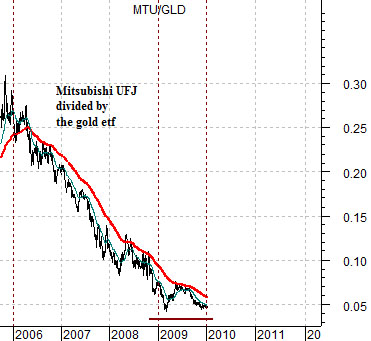

The chart below right shows the ratio of Japanese bank Mitsubishi UFJ (MTU) to the gold etf (GLD).

The charts have been offset by two and a half years.

We have argued on occasion over the years that the cyclical trend lags behind changes in bond prices by roughly two years. Today we are stretching the lag out by an additional six months. The upside down chart of yields is actually our way of indicating the trend for PRICES so the easiest way to process the meaning of the chart at top right is to think in terms of Treasury PRICES instead of yields.

The argument is that bond prices peaked in 2003 and bottomed in mid-2006. The top for the MTU/GLD ratio was reached around the end of 2005 suggesting a potential lag of 2 1/2 years to the bond market.

With the charts set up in this fashion we get the sense that the MTU/GLD ratio’s flat line through 2009 may actually be a reflection of the bottom for bond prices that extended for twelve month between mid-2006 and mid-2007.

The point we are attempting to make is that there is a lagged relationship between the cyclical trend (shown here using the MTU/GLD ratio) and the bond market. To the extent that bond prices pulled the trend lower from 2006 into 2009 then the sharp rally in bond prices from the second half of 2007 through 2008 may create surprising upward pressure on the financials and downward pressure on gold prices through the balance of this year.

Equity/Bond Markets

The ‘cyclical trend’ is a fairly broad concept in that it includes everything from the biotechs to the airlines. In general it represents the kind of trend that involves money pushing away from safety in search of growth instead of income.

In any event… at right we compare the sum of copper futures and crude oil futures with the spread or price difference between the biotech etf (BBH) and Potash Corp. (POT).

We are not going to go into all the myriad details concerning when the biotechs lead and when the fertilizer stocks take a turn. The point that we are attempting to make is that as long as the trend is higher for copper and crude oil the share price of POT will tend to be stronger than the BBH. If the commodity trend starts to lag some time this year in response to a stronger dollar the biotechs should return to relative strength. Notice that over the past year or so the spread between BBH and POT has ranged from +30 to -30 suggesting at least the potential for switching back and forth between the two when either extreme is approached.

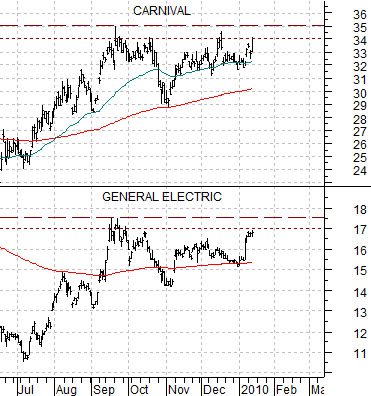

Below is a comparison between General Electric (GE) and Carnival Cruise Lines (CCL). One of the features within the markets at present is the close proximity by so many large cap names to chart-based resistance. In other words both GE and CCL are having trouble pushing above the September highs. If these levels are broken then the broad market should be able to run upwards at an accelerated pace.

We argued a week or two back that one of the keys for the Japanese cyclicals is a declining Japanese bond market. The share price of Panasonic (PC) has been on the rise since the start of December following the last price peak in the Japanese 10-year (JGB) bond futures. As long as the JGBs are pushing lower the Japanese stock market will tend to outperform the S&P 500 Index.