We are going to combine the two-year lag, markets relentlessly coming back ‘on trend’, and the thesis that we will see upward pressure on yields into the autumn of 2012. As well we will tuck in an argument in favor of the ‘laggard banks’.

The two-year lag is based on the idea that the trend for interest rates today shows up in the trend for cyclical asset prices two years later. Another way of putting this would be that the trend for yields two years ago is helping to drive the current trend for cyclical asset prices.

Most dramatic moves in the markets- the crashes and bubbles- reflect a market coming back ‘on trend’. In other words whenever prices absolutely collapse or simply will not stop rising the explanation is that prices are returning to a previously established trend.

The ‘decade theme’ argues that a major market peaks around the start of each new decade and then makes its first bottom around the fourth quarter of the ‘2’ year. We have suggested that the ‘major market’ is likely short-term debt prices so if the ‘decade theme’ works once again we should see downward pressure on short-term debt prices through into the autumn of 2012.

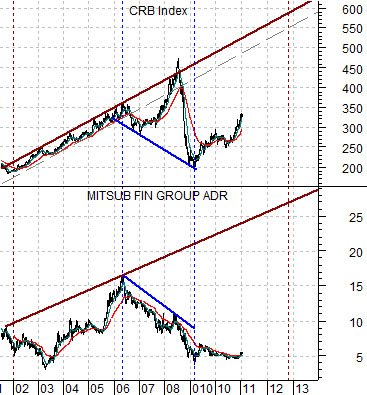

Just below is a chart of the sum or combination of 3-month TBill yields and 10-year Treasury yields from 1999 to the present day. We use this sum to represent the overall trend for yields.

Next is a chart of the CRB Index and laggard bank Mitsubishi UFJ (MTU). This chart has been set up so that it runs two years behind the sum for yields (i.e. 2000 for yields is directly above 2002 for commodity prices and MTU).

Over the past decade or so there have been three distinct trends. Yields tumbled between 2000 and 2004 creating a positive trend for cyclical asset prices from 2002 into 2006. Yields rose from 2004 into 2007 creating a negative trend for the CRB Index and MTU from 2006 into 2009. The collapse for the CRB Index in 2008 reflected a market coming back on trend. Next yields declined from 2007 into the autumn of 2010.

The point is that the cyclical trend should remain positive right through into the autumn of 2012 as yields track higher. The CRB Index could conceivably swing back ‘on trend’ with commodity prices moving to new highs next year. The laggard banks are… lagging… but if the wind blows hard enough we could see significant price gains over the next six to seven quarters.

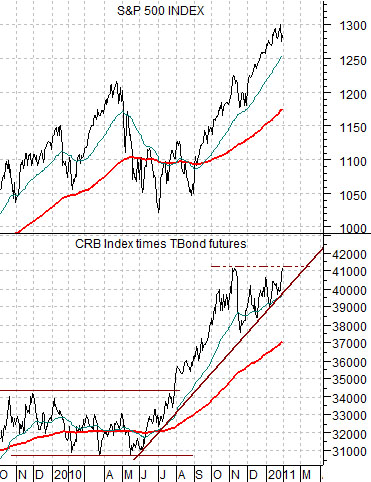

Below is a chart of the S&P 500 Index and the sum of the price of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY) futures. We included this chart on page 5 of yesterday’s issue but thought that we should drag it forward so that we could take another run at an explanation.

From August of last year to the present day the SPX has risen as the sum of the TBond and dollar has declined. What does this mean?

Our thought is that the equity market is benefiting from two distinct trends. First, the bond market is falling in price as expectations about future economic growth improve. Second, the dollar is not trending higher in a manner that would be negative for commodity prices. The combination of perceptions of improved cyclical growth (falling bond prices) without offsetting strength in the dollar is helping to power the equity markets steadily higher.

Our point is that until something changes- either through bond price or dollar price strength- the SPX looks higher. And higher.

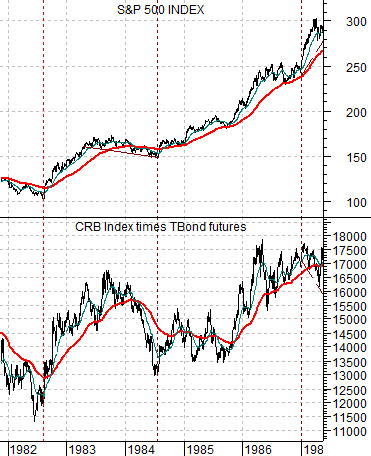

Below is a chart of the SPX and the product of the CRB Index times the TBond futures from roughly 1982 into 1987.

The ongoing argument is that similar to 1982- 87 the trend for the SPX should be fairly close to the trend for the combination of commodity and bond prices. As long as commodity prices are rising as fast or faster on a percentage basis as bond prices are declining then the SPX should continue to trend higher. This has most certainly been the case since the middle of 2010. As we pointed out yesterday… since nothing much had changed it seemed to make sense to hold on to a positive equity markets view even in the face of Egypt’s problems.