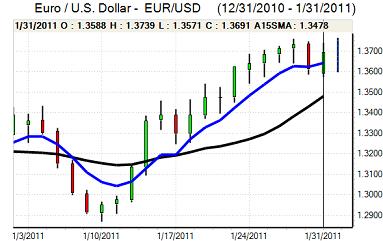

EUR/USD

The dollar was unable to make renewed gains against the Euro during Monday and gradually weakened to test important support levels close to 1.3750. Although tensions surrounding the Egyptian protests continued, risk appetite stabilised and this dented any safe-haven demand for the US currency. There was also persistent reports of sovereign buying which underpinned the Euro, especially with evidence of month-end demand.

The US personal spending data was slightly stronger than expected and there was also a very strong reading for the Chicago PMI index which rose to a 20-year high of 68.8 from 66.8 the previous month. There was, however, a subdued reading for the core deflator inflation reading which maintained expectations that the Federal Reserve would maintain a very accommodative policy. Yield spreads against the Euro have stabilised, but the dollar’s position is still significantly weaker than at the beginning of 2011.

The Euro-zone flash inflation estimate rose to a 27-month high of 2.4% for January from 2.2% previously as energy costs rose. The firm reading maintained expectations that the ECB could move closer to increasing interest rates at Thursday’s council meeting and the Euro maintained support on yield grounds.

There will also be speculation that EU leaders can move closer to a deal on increasing the Euro-zone bailout fund at a summit of Friday which will also provide near-term Euro support. There will still be fears over internal divisions and sentiment will be prone to a sharp reversal.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain any fresh buying support on Monday and dipped to test support below 82.0 on Tuesday, the weakest level since the first week of 2011.

The official Chinese PMI index did decline to 52.9 for January from 53.9 the previous month, but there was a further increase in the prices component which may trigger fears over a further tightening of Chinese monetary policy. Overall risk appetite stabilised, however, which should have lessened any defensive demand for the Japanese currency.

The domestic data recorded a decline in average earnings for the first time in 8 months which will maintain fears over the outlook for consumer spending. There will be the risk of Finance Ministry verbal intervention and semi-official buying by the Postal Savings fund. Nevertheless, the dollar was trapped below 82 in Asian trading on Tuesday.

Sterling

Sterling found support below 1.59 against the dollar during Monday and advanced strongly to a 10-week high around 1.6070 during the Asian session on Tuesday. There was strong Euro buying on the crosses which helped underpin the UK currency while there was stop-loss buying against the dollar. Sterling also benefited from an improvement in global risk appetite.

MPC member Weale stated that it was preferable to raise interest rates slightly to control the inflation risks. These comments were not surprising given that he had voted for higher rates at the January meeting, although he also cautioned that pressure for higher rate would fade if the economy weakened.

Futures markets were pricing in around a 50% chance of a rate increase by May and the PMI data will be watched closely over the next few days to assess economic conditions. Volatility is liable to remain high with interest-rate expectations also likely to shift frequently on conflicting growth and inflation pressures.

Swiss franc

The Euro found support below 1.28 against the franc and rallied to a high near 1.2950 as risk appetite improved. The US currency was unable to gain any traction against the franc and dipped sharply to lows below 0.94 before recovering some ground.

There will be reduced defensive demand for the franc if international risk appetite continues to improve, but there will still be the risk of volatile movements.

There will be unease that franc strength will damage the Swiss economy and there will be some continuing pressure for National Bank action to curb currency strength.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

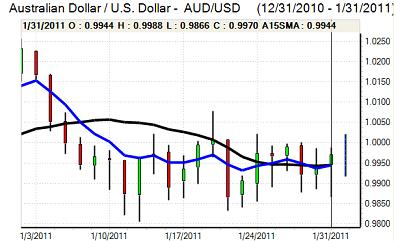

Australian dollar

The Australian dollar found support below 0.99 against the US currency during Monday and rallied steadily towards parity as the US currency remained under pressure.

The domestic data offered no support for the currency with the PMI manufacturing index remaining below the pivotal 50 level while there was a decline in the latest NAB business confidence index.

As expected, the Reserve Bank of Australia maintained interest rates at 4.75% following the latest policy meeting and there will be expectations of a neutral stance in the short term as the bank called the current situation comfortable. Wider US vulnerability allowed the Australian dollar to move above the parity level on Tuesday.