Alcoa traditionally leads off the quarterly earnings parade but from our perspective the real party starts today as large cap names such as IBM, Intel, Johnson and Johnson, Goldman Sachs, etc. report how their business fared over the first quarter of the year.

Our view is that if nothing much has changed we are very close to a bottom for copper futures prices and we can make a tenuous case that key tech stocks like Intel and Cisco stand a fighting chance over the next while of doing somewhat better.

The key in the paragraph above revolves around the ‘if nothing much has changed’ comment. In an Asian growth/commodity price-driven trend there will always be periods of time when commodity prices take a step backwards. If there are no other major themes doing the heavy lifting the stock market indices are bound to decline when raw materials prices stop pushing.

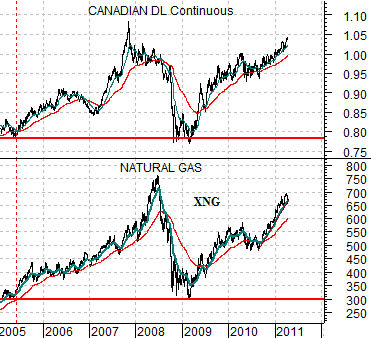

So… are there any ways to discern whether ‘nothing much has changed’? One way to view this would be through the commodity price-sensitive Canadian dollar.

Below is a comparison between the Canadian dollar (CAD) futures and the Natural Gas Index (XNG) from 2005 to the present time period.

One might argue that the Cdn dollar shouldn’t be trending with the share prices of the natural gas producers but… given that the charts have been almost identical for years and years… we will suggest that this is something more than a mere coincidence. The basic trend for the Cdn currency is the same as the basic trend for the gas stocks.

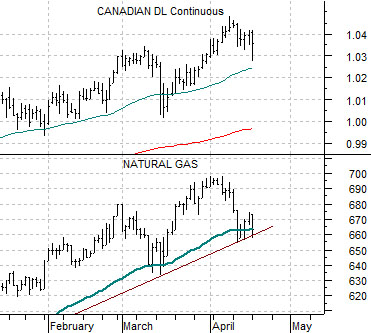

In recent days the XNG has been just a bit weaker than the Cdn dollar. The shorter-term view shown below right makes the case that the last time the XNG declined to its 50-day e.m.a. line (in mid-March) the CAD corrected back to its moving average line. Through the first half of this month the XNG has fallen to a level that would be roughly associated with the CAD about a point below yesterday’s close but… aside from that… the basic argument is that the Natural Gas Index has made repeated declines to its moving average line since the trend shifted into high gear late last summer and has found support at this line on each and every occasion.

If ‘nothing much has changed’ the XNG should hold above 655 while the Cdn dollar continues to grind upwards as money chases all things related to energy prices in specific and raw materials prices in general.

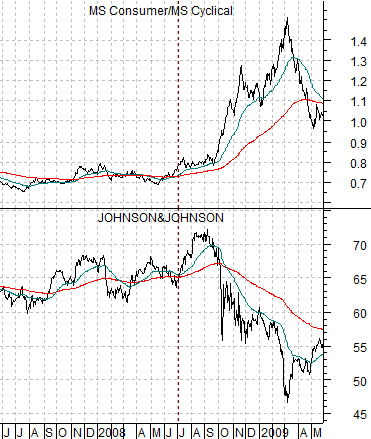

In a few recent IMRA issues we have focused on the ratio between the Morgan Stanley Consumer Index and Morgan Stanley Cyclical Index. The argument was that as long as yields are rising the cyclical sectors should outperform. We pegged a likely top for U.S. Treasury 10-year yields around the 4.5% level.

With 10-year yields currently at 3.37% the cycle appears to be taking a pause for the cause. The problem is that the further yields decline the greater the downward pressure on the economically sensitive cyclical sectors.

Now… one of the arguments that we made (again and again) between 2007 and 2008 was that the broad U.S. stock market can rise OR fall when the trend shifts from cyclical back to consumer strength. In large part the outcome depends on the reaction by the consumer stocks.

Below is a chart of the ratio between the MS Consumer and Cyclical indices along with a chart of Johnson and Johnson (JNJ). In 1994 the trend shifted from cyclical to consumer and the share price of JNJ started to rise. With large cap consumer stocks pushing higher… the broad market rose steadily.

The next chart shows the same comparison for the time period between the summer of 2007 and the spring of 2009. Notice that JNJ began to rise as the ratio turned higher in mid-2008 before… collapsing. If the consumer stocks outperform the cyclical stocks by merely falling at a slower pace the broad market will collapse. As was the case in 2008.

Last is the present situation. We have had a minor rise in the ratio in response to falling long-term yields with a tepid price gain- so far- for JNJ. This is exactly why the stock market appears to be living and dying with even small changes in raw materials prices. It has been, after all, the only game in town.