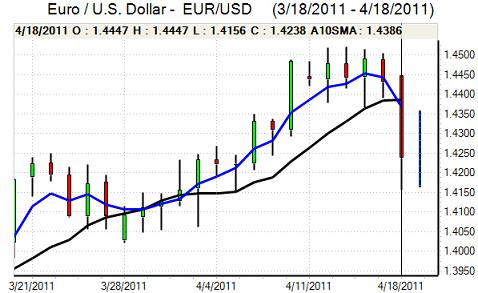

EUR/USD

The Euro remained under pressure during the European session on Monday as volatility also spiked higher. After initially being unsettled by the Finnish election result which increased the risk that a bailout for Portugal would be rejected, markets then focussed on the Greek default risk.

Confidence in Greek debt was damaged following media reports that the government had sought a debt restructuring at the previous Ecofin meeting. This was denied by the government, but there were also comments from German officials that Greece was unlikely to be able to last beyond the Summer without some form of restructuring. Markets were extremely suspicious over official comments amid strong speculation that debt-restructuring talks were officially underway.

There was also a relatively disappointing Spanish bond auction result which increased unease over the Euro contagion risk and triggered a renewed widening in yield spreads. The Euro was also unsettled by a general deterioration in risk appetite.

The Euro-zone debt woes were overshadowed in US trading by Standard & Poor’s decision to put the US AAA credit rating on negative watch. The ratings agency was concerned over the US budget trends and substantial increase in debt-servicing costs. Although an actual downgrading was still considered very unlikely on a two-year view and Moody’s was more optimistic, the negative rating reinforced a lack of dollar confidence. The Euro initially recovered from lows near 1.4260 against the dollar, but selling pressure increased again and it weakened to lows below 1.4170 in New York before stabilising later in the US session.

A lacklustre NAHB housing report reinforced doubts over the US economy and expectations that the Fed will resist any near-term tightening which also held back the dollar on yield grounds and reinforced a general lack of trust in the dollar and Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any significant headway against the yen during Monday and retreated to lows around 82.20 during the US session before finding support.

The Japanese currency gained support from a general deterioration in risk appetite with a sharp drop in commodity prices also increasing the potential for a reduction in carry trades funded through the yen.

In fundamental terms, there were renewed doubts surrounding the Euro-zone and US economies as debt-restructuring and credit-rating fears increased. Given the importance of relative fundamentals, the yen tended to gain by default despite a lack of confidence in the Japanese economy.

There was some evidence of importer buying at lower levels which provided some dollar relief, especially with a general rise in US Treasury yields.

Sterling

Sterling was firmly on the side-lines during Monday as attention focussed on the Euro-zone and US economies.

Domestically, the short-term focus will tend to be on the Bank of England minutes which are due for release on Wednesday. Following the release of weaker than expected inflation data and persistent fears over the growth outlook, markets have scaled back their expectations of interest rate increases with futures markets not expecting an increase at the May meeting. Given this shift in expectations, Sterling will gain support if the minutes are more hawkish than expected.

The Euro-zone developments will be watched in the short term and Sterling has the potential for some support as a perceived safe-haven from the Euro stresses. The UK banking sector will, however, also be watched very closely and the currency will be much more vulnerable to selling pressure if fears over bad debts increase again.

Sterling dipped to lows below 1.6170 against the dollar as the US currency advanced strongly before rebounding to the 1.6250 area while its recent recovery against the Euro continued with a move to the 0.8750 area.

Swiss franc

The dollar advanced to a high near 0.90 against the franc during Monday, but it was unable to extend the gains and retreated to test support in the 0.8950 area. The dollar was undermined by general franc strength on the crosses as the Euro weakened to test support below 1.2750.

Safe-haven considerations have inevitably dominated during the past 24 hours with the Swiss currency gaining support from an increase in fears surrounding Euro-zone debt restructuring as well as the US being put on negative rating watch by one of the major ratings agencies. The franc also gained support from weaker equity markets as high-yield trades were scaled back.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

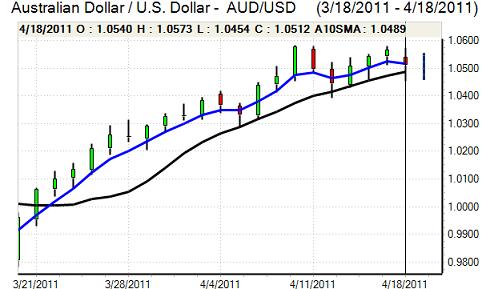

Australian dollar

The Australian dollar was unable to make a fresh attack on resistance above 1.0570 against the US currency during Monday and was subjected to significant selling pressure as risk appetite deteriorated in tandem with a decline in commodity prices.

The currency dipped to lows near 1.0450 and was unable to secure fresh buying support. Domestically, the Reserve Bank minutes were broadly in line with expectations, but a slightly more cautious outlook over growth did undermine the Australian dollar slightly. There were also further doubts surrounding the housing sector on expectations of tighter loan standards.