March 10 (Bloomberg) — The worst of Greece’s financial crisis is over and other European nations won’t follow in its path, said former European Commission President Romano Prodi.

It often feels as if markets crises appear right out of the blue. Typically, however, a problem builds until it hits the front pages of the newspapers and then fades away as investors flip back from fear to greed. Eventually the underlying issue explodes into a crisis once again catching investors on the wrong side of the trend. The point is that it often isn’t the first break that you have to worry about but the second or even the third. Is Greece’s financial crisis now over? We have no idea. We do know, however, that our thesis is that if the euro breaks to new lows a few months from now we are going to do our best to head for the exits as quickly as possible.

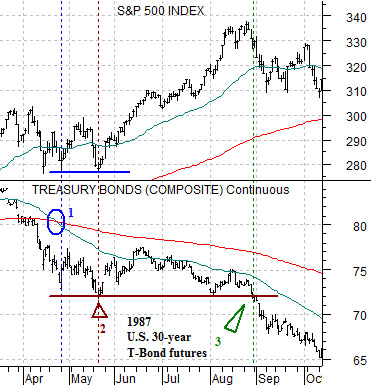

Below we show a comparison between the S&P 500 Index (SPX) and U.S. 30-year T-Bond futures from 1987.

The ongoing argument has been that the equity markets corrected as the bond market declined to a bottom into May of 1987 and then swung right back up to the bullish trend in June. The bond market was, by the way, ‘the problem’ but as long as bonds were not making new lows the equity markets were able to rise.

When the TBonds finally began to weaken in August of that year the S&P 500 Index started to work through a ‘top’. By end the end of August the TBonds had fallen to new lows but even then the SPX managed to take yet another run at the highs through September before ‘crashing’ in October. The equity markets were following the bond market, the break to new lows by the TBonds in August represented the straw that broke the markets’ back, and even then it still appeared as if this happened ‘right out of the blue’.

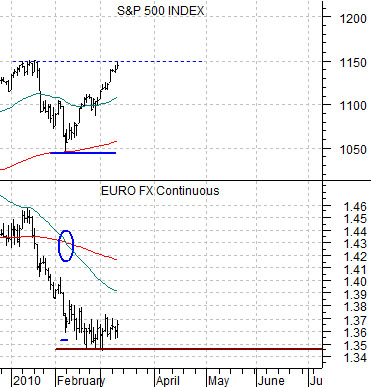

Further below we show the S&P 500 Index and the euro futures from late 2009 to the present day.

Our thesis is that the euro could be this year’s bond market. The SPX fell sharply as the euro tumbled and then returned to its rising trend once the euro found support around the 1.35 level. The thought is that as long as the euro is able to hold above 1.35 the equity markets should be stronger. New lows for the euro later this year would argue that the worst of Greece’s financial crisis is not, in fact, over so hopefully if the markets get hit then at least it won’t feel as if it was right out the blue.

Equity/Bond Markets

Below is a comparative view of the U.S. Dollar Index (DXY) futures, U.S. 3-month TBill yields, and the share price of Wal Mart (WMT).

Below we compare gold futures with the ratio between the Bank Index (BKX) and the S&P 500 Index (SPX).

One of our arguments has been that if a falling dollar, tumbling interest rates, and weakness in the banks helped push gold prices higher then shouldn’t a reversal of these trends weigh on gold prices?

There are a number of important relationships on the go but somewhere near the top of the list would be gold versus the banks. If gold prices are not weak then our conviction with respect to the banks has to remain somewhat tenuous. At present we have the dollar and short-term yields working higher as the BKX/SPX ratio rises. The offset should be weakness for gold prices. In terms of our thesis yesterday was a reasonable day.

Gold was not the only haven for money seeking safety following the start of declining home prices and pressure on the banks back in 2007. We would add the Japanese yen and the bond market to the list of safe harbors.

The chart below compares the Nikkei 225 Index to the product of 10-year Japanese (JGB) bond futures times the Japanese yen futures.

If the yen and JGBs represented the same basic trend that pushed gold prices from 600 to 1200 and the gold/CRB Index ratio from 2:1 up to 5:1 then the argument would be that weakness in gold prices should go with weakness in both the yen and the Japanese bond market. The offset to a trend change in all three markets should be strength in the Nikkei 225 Index. The chart below argues that it would take a push nicely above 11,000 to seal the deal.