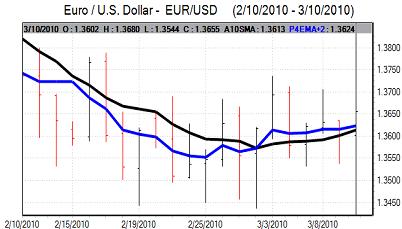

EUR/USD

The Euro again dipped to test support below 1.3550 against the dollar on Wednesday and the US currency was also unable to sustain a break below this level for the second day.

The Euro was able to stage a technical recovery during the day, bolstered by the ability to hold support and there was also some easing of tensions surrounding the Greek debt situation. The Euro pushed to highs above 1.3650 during the New York session as risk appetite was firm.

There were no major US economic data releases during the day, although the budget deficit was at a record level for February which is likely to cause some renewed doubts over the US fundamentals and may hamper the dollar.

US Federal Reserve policy will be an important focus over the next week with the latest FOMC meeting due to be held on March 16.. There have been further comments from Fed officials suggesting unease with the terminology stating that interest rates will be left at very low levels for an extended period. In this environment, there is likely to be increased expectations of a change in the Fed’s language following the meeting.

This speculation should provide some support to the dollar, although buying will be limited by doubts whether interest rates will actually be increased in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Trading conditions were generally subdued in Asian trading on Wednesday. There was a strong reading for Chinese imports in the latest trade data which helped boost confidence in regional economies and also tended to boost commodity currencies against the yen as risk appetite held relatively steady.

There was also some evidence of importer dollar buying in quiet conditions. There was still a reluctance to sell the yen heavily, especially with the potential for capital repatriation over the next few weeks. The dollar initially consolidated close to the 90 level with the Euro unable to make any headway.

During the day, there was renewed speculation over additional Bank of Japan action to cut interest rates and this was important in curbing yen demand with the dollar pushing to a high of 90.80 against the yen while the Euro strengthened to a high near 124 during the US session.

Sterling

The UK currency remained under pressure on Wednesday as selling pressure above 1.50 persisted with the Euro approaching resistance close to the 0.91 area and the trade-weighted index weakened to an 11-month low.

The latest UK industrial data was weaker than expected with a 0.9% decline in manufacturing output for January, contrary to expectations of a monthly increase, although the data is likely to have been distorted by bad weather conditions.

The NIESR estimated that GDP rose 0.3% in the year to February following a revised 0.6% increase the previous month. The data will maintain expectations that the economy is recovering, but doubts over the economy’s strength will also continue.

Bank of England member Posen downplayed the risk of a sterling downturn, although he would not be in a position to say anything else. Underlying confidence in the economy will still be very weak with continuing fears over the government-debt situation. A weaker US currency did allow a Sterling recovery to near 1.50 from lows below 1.49.

Swiss franc

The dollar unable to push above the 1.08 level against the franc during Wednesday and weakened to lows just below 1.07 during the US session as the dollar was subjected to a wider downturn.

The Euro strengthened to highs just above 1.4630 against the franc at one point on renewed speculation that the National Bank had intervened to weaken the Swiss currency, but the Euro was unable to sustain the advance.

The central bank policy meeting will inevitably be an important focus during Thursday. There will be speculation that the bank will signal a greater tolerance of franc appreciation following the meeting and any confirmation of this could trigger sharp franc gains although volatility levels are liable to be high.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

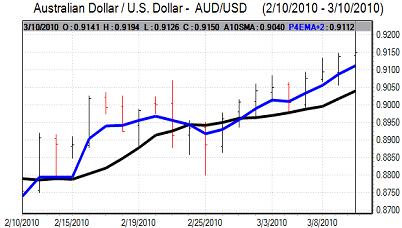

Australian dollar

The Australian currency maintained a firm tone on Wednesday and pushed to a high around 0.9190 against the US dollar during the US session.

The robust data on Chinese exports and imports underpinned confidence in the Australian currency on hopes for a buoyant trend in global trade. There was also some optimism that there would be another favourable employment report released overnight, although the currency was unable to sustain its best levels.