With more than three decades of experience in the financial markets there are still very few things that we can argue with complete certainty. Near the top of the list, however, is the ‘you can set your watch by it’ tendency for the financial press to argue that the Fed has failed in its efforts to either slow or accelerate economic growth. Yet… to the best of our knowledge the Fed is still batting a thousand.

The point is that when the Fed wants to slow the pace of economic expansion… it succeeds. With a lag. Between the start of its efforts and the inevitable (but always surprising) outcome there is typically a period of time when the markets come to conclusion that this time is different, that some exogenous factor has swamped the Fed’s ability to damped growth.

On the other hand when the Fed attempts to stimulate growth… to the best of our knowledge… growth is stimulated. With a lag. For all we know this time may be different. For all we know policy competition from China or the ECB is muting the Fed’s ability to dictate the pace of global economic activity. Yet… with more than three decades of experience in the financial markets… we are still willing to give the Fed the benefit of the doubt.

The point is that while China tightens credit and the ECB raises short-term rates the Fed continues to hold the gas pedal flat to the floor. If history repeats growth will surprise to the upside. Our sense, however, is that we are weeks if not days away from the answer to this issue.

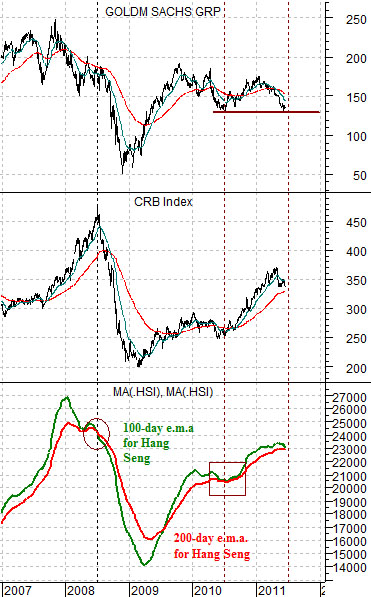

Below is a chart comparison between Goldman Sachs (GS), the CRB Index, and two moving average lines for the Hang Seng Index from Hong Kong.

The argument is that when the moving average lines for the Hang Seng Index ‘cross’ to the down side the trend for the CRB Index turns bearish. We have included the chart of GS because in recent years it has trended in the same basic direction as the Hang Seng Index.

The moving average lines ‘crossed’ in 2008 and the commodity markets collapsed. The moving average lines converged but did not ‘cross’ in 2010 and the CRB Index resolved higher. For the third time in four years the lines are moving together right at the end of the second quarter. We will continue with this argument below.

The first chart below shows the Hang Seng Index along with the 200-day e.m.a. line (in red) and 100-day e.m.a. line (in green) from 2007 into 2008.

The choice of the 100-day and 200-day exponential moving average lines is, as one might expect, somewhat arbitrary. In our defense we came up with this particular argument more than a decade ago and it has served us fairly well over the years.

The Hang Seng Index peaked in the autumn of 2007 while the CRB Index reached a top at the end of June in 2008. The shift from bullish to bearish commodity price trend was marked by the ‘crossing’ of the Hang Seng Index’s moving average lines.

Next we feature the same chart from 2009 into 2010. Notice that the Hang Seng Index peaked in the autumn of 2009 and was well below the moving average lines in early June of 2010. The outcome, however, was almost exactly the opposite of 2008. Instead of the index collapsing into October/November- as it did in 2008- it drove powerfully higher through October and into November.

Below is a chart of the current situation. The Hang Seng Index peaked in the autumn of last year and is now well below the moving average lines. As we approach the end of this year’s second quarter the markets have a fairly major decision to make. And soon. Are we going to follow 2008’s path with growth imploding into the fourth quarter or are we going to do a repeat of last year with Asian growth (represented by the Hang Seng Index) firing higher for the next four to five months? Given that the yield curve was inverted in 2007 and was extremely steep last year our ‘lean’ is towards ‘surprising’ economic strength. Yet, as in all cases, the ultimate decision lies with the markets and at present the best we can do is suggest that a decision of some magnitude is looming on the very near horizon.