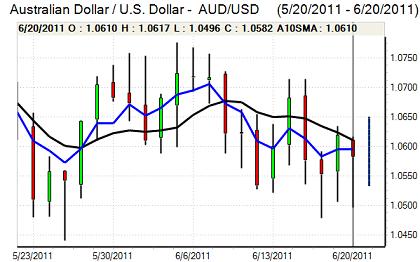

EUR/USD

The Euro tested support below 1.42 against the dollar during Monday with further unease over the Greek situation following the decision to delay ratifying the next Greek loan tranche.

There was some improvement in confidence during the day as officials looked to reassure markets. The EU will approve further support for Greece on the condition that there is parliamentary approval for the latest austerity measures. The Greek government faces a no-confidence vote late on Tuesday and victory in the vote should also guarantee passage of the fiscal measures. There was still a high degree of uncertainty given the narrow government majority, but there was greater confidence that an immediate melt-down in the Euro could be avoided.

From a longer-term perspective there were further warnings over the Euro outlook, especially with little confidence that the Greek government will be able to deliver on austerity measures. There was further negative media rhetoric surrounding the underlying Euro outlook and Fitch warned that even a voluntary debt rollover would be considered a default.

There were no significant US economic data releases, but there were expectations that the Federal Reserve would downgrade its growth forecasts at the Wednesday FOMC meeting. There were also expectations that the Fed would maintain a highly-expansionary monetary policy which continued to sap support for the dollar on yield grounds. Fundamental concerns also persisted as ratings agencies continued to warn over the consequences on missing forthcoming coupon payments if there is no approval to raise the debt ceiling.

There was a tentative improvement in risk appetite and the Euro pushed to highs around 1.4380 before retreating back to the 1.4350 area in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to the 80 level against the yen during Monday and edged higher to the 80.35 area, but was unable to make any significant headway and drifted weaker again in Asia on Tuesday. The dollar was again sapped by a lack of yield support and expectations that the Fed would maintain a loose monetary policy.

Significantly, the yen proved to be broadly resilient in the face of a steadying in risk appetite and this suggested that underlying selling pressure on the yen is limited at this stage. The government upgraded its economic assessment which had some positive impact in supporting the Japanese currency.

Finance Minister Noda stated that he was prepared to take bold action in the currency markets if necessary and there was caution over yen buying close to the 80 level given the possible intervention threat.

Sterling

Sterling found support close to 1.61 against the dollar during Monday and rallied to a peak just above 1.6250 before stalling. Much of the gain was related to general dollar weakness and Sterling was unable to sustain gains through 0.88 against the Euro.

There is some evidence that the UK is gaining defensive support given its position outside the Euro area, especially with the government resisting pressure to fund part of a second Greek rescue package. Nevertheless, there are still important risks to the UK, especially given underlying vulnerability within the banking sector.

Overall confidence in the UK economy also remains weak, especially with major fears over the outlook for consumer spending as disposable income remains under pressure. There were also expectations that the Bank of England minutes due for release on Wednesday would indicate that the bank was no nearer sanctioning a rate increase. In this context, the currency is still being supported by fundamental weakness elsewhere rather than any real support for Sterling.

Swiss franc

The dollar was again unable to break above resistance in the 0.85 area against the franc and retreated to lows just below 0.8420 before finding some support as the Euro struggled to hold above the 1.21 level.

There was some easing in defensive franc demand on reduced fears over an immediate Greek debt default. Underlying confidence remains very fragile, especially with the threat of persistent capital flows away from the Euro area given longer-term fears over the currency’s future.

There was some nervousness over the possibility of verbal intervention which also triggered a covering of long speculative franc positions at times.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

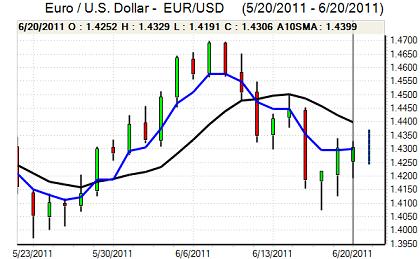

Australian dollar

The Australian dollar again found support close to 1.05 against the US dollar during Monday with reports of solid buying support and the currency rallied to a high just above 1.06 as risk appetite staged a tentative recovery and the US dollar lost ground.

The latest Reserve Bank minutes reaffirmed the comments that a further increase in interest rates would be required eventually. There were more dovish comments surrounding the global and domestic economy and a comment that there was no urgency which triggered a fresh Australian dollar retreat to the 1.0550 level. The currency was also hampered by unease over the Chinese economic risks.