Nov. 3 (Bloomberg) — The Federal Reserve will buy an additional $600 billion of Treasuries through June, expanding record stimulus and risking its credibility in a bid to reduce unemployment and avert deflation.

From our perspective whether the Fed is going to buy $500 billion, $600 billion, or even a trillion dollars worth of Treasuries isn’t the issue. The real issue is how the markets react to the news.

We have argued over time that offset to cyclical pressure on the financial system has been a steady price climb in a number of other markets. Chief amongst these are gold, the Swiss franc, the U.S. bond market, and the Japanese yen. While we may spend far too much time trying to find a bottom for the Japanese equity market and relative strength for the major banks the reality is that the sectors going down aren’t about to turn higher until the sectors rising in response start to falter.

Our view was that in a perfect world the Fed’s quantitative easing announcement followed by some kind of response by the Bank of Japan later this week would be ‘enough’. By this we mean that the markets would conclude that the time had come to stop worrying the impact of real estate prices on the banks and the rising yen on the Nikkei.

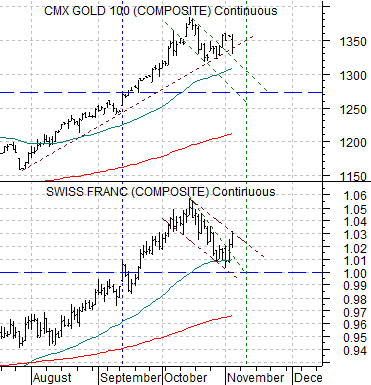

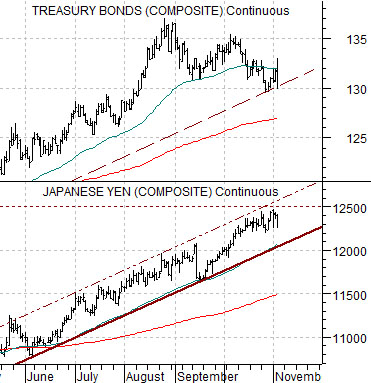

In a sense we were quite encouraged by yesterday’s action. At right we show comparisons of gold futures and the Swiss franc futures along with the U.S. 30-year T-Bond futures and the Japanese yen futures.

These are the four ‘poster children’ for the current trend. One can see that the Swiss franc reached a peak in mid-October but as long as gold prices continued to push higher the prospect of a trend change was still in doubt. At the same time the bond market reached a price top at the end of August but with the yen still driving towards 125- the high set way back in April of 1995 at THE low for the U.S. Dollar Index- the issue was most certainly undecided.

The bottom line is that the initial reaction following the Fed’s announcement was somewhat encouraging. Not conclusive, of course, but encouraging. The TBond futures declined to support, the yen faded back from 125, and gold prices weakened marginally.

Equity/Bond Markets

Nov. 3 (Bloomberg) — General Motors Co. said it will raise as much as $10.6 billion in an initial public offering that will reduce the U.S. and Canadian governments’ stakes in the largest U.S. carmaker.

GM, 61 percent owned by the U.S. Treasury Department, will offer 365 million shares at $26 to $29 each, the company said today in a filing with the Securities and Exchange Commission.

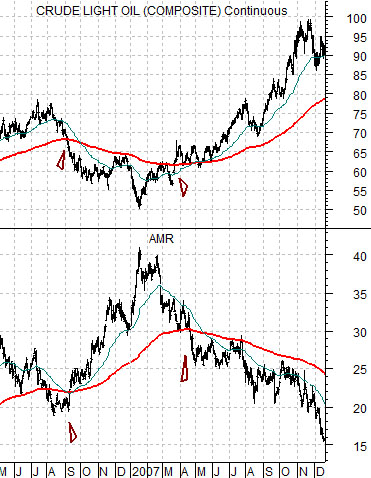

First up is a chart of crude oil futures and the share price of AMR from 2006- 2007.

We often argue that the markets work as offsets with strength in one sector creating weakness in another. During the last decade we tended to get rallies in the airlines each time crude oil futures stopped rising or started to weaken. The share price of AMR, for example, moved above its 200-day e.m.a. line in September of 2006 as crude oil futures moved below its moving average line. The process reversed in early 2007 as the upside break for energy prices pulled AMR back below its 200-day e.m.a. line.

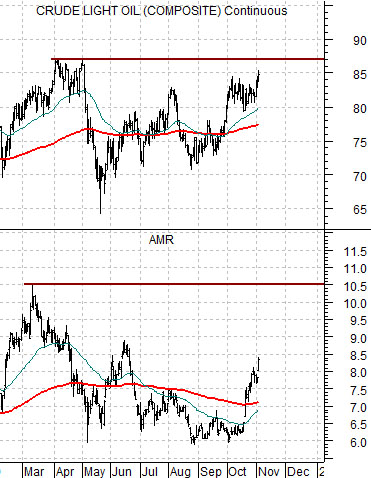

The current situation is shown further below. The trend is quite different these days as the cyclical sectors move up and down together.

In any event… that isn’t really our point today. We wonder some times whether prices create or reflect reality. In other words do rising oil prices represent growing demand or do they, in fact, represent a market that has little else to do?

Lastly is a chart of the S&P 500 Index and the ratio between Ford (F) and heating oil futures. Our thought is that an upside break out by the F/heating oil ratio should go with new recovery highs for the SPX. With General Motors close to an initial public offering it may be that the autos are set to come back into focus. One of the best ways to cool the rising trend for crude oil prices may simply be through providing the market with an alternative. Our interest in the autos and airlines remains piqued although we are not sure whether the trend will survive an upside break by crude oil through the 87- 88 level.