TD Ameritrade’s IMX (Investor Movement Index) hit an all-time high in December, as leverage remains at historic high levels. The stock market continues to find buyers with every drop and the buy the dip strategy has worked out very well for most traders.

But there are some things that appear to be changing. Gold, which has had a nice bounce off the lows and I still see more room to run (GLD 129ish) was moving down all of 2013 as the major indexes were moving higher. We also have a fractured look between the indexes. The Dow has yet to make new highs along with the other indexes-for now. This may end up fixing itself shortly, but at this stage, it is still a fractured environment.

With the recent jobs report adding a dismal 74,000 jobs as the participation rate has dropped to levels not seen in some 35 years-the economic picture is anything but roses and rainbows. The Baltic Dry Index has crashed some 40% since December and is the worst start in over 30 years, isn’t helping the global growth story either.

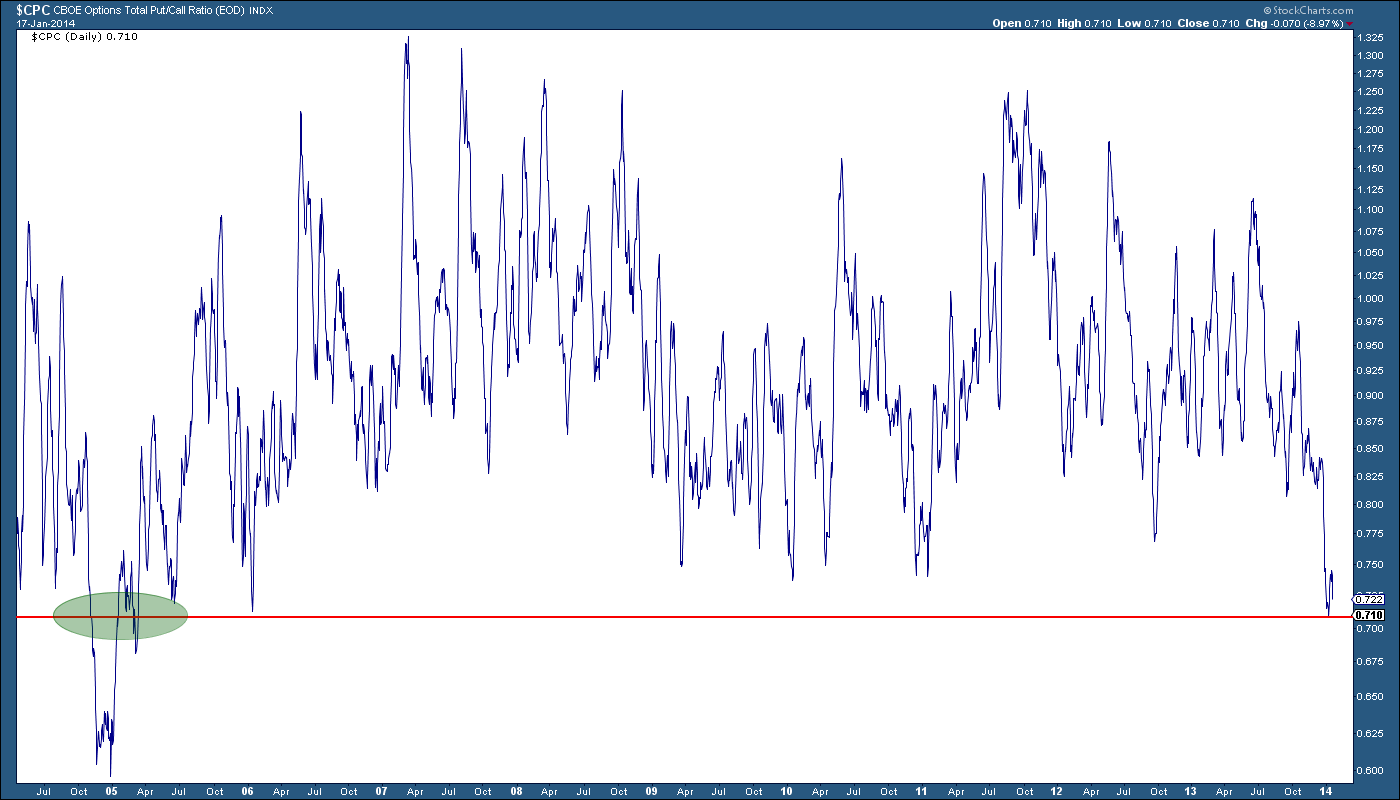

But even with these dismal economic numbers, investors/traders have pushed the 10 dma of the $CPC to levels not seen in over 9 years. This is not a reason to drop and sell everything, but it is the time to start looking over your shoulders.

With retail traders moving into this market every month, (even if the CNBC-ers say they aren’t) combined with this level of complacency, a fractured market and leverage at extreme levels, buying some type of protection for a drop would be very wise.

http://behavioralmarkettrading.com/