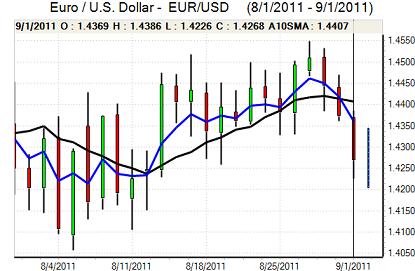

EUR/USD

The Euro was unable to regain the 1.44 level in European trading on Thursday and was again subjected to heavy selling pressure as it dipped to the lowest level since the middle of August.

The latest PMI data was weaker than expected with the revised manufacturing index dipping to the lowest level since June 2009 with a reading of 49.0 from the flash estimate of 49.7 which suggests that conditions deteriorated sharply late in the survey period.

There were further concerns surrounding the European banking sector with reports that many banks were effectively shut-out of international markets or were able to access funds for very short-term periods only. There was further buying of European peripheral bonds by the ECB, but the impact was less than that seen in previous days and it struggled to overcome the negative impact of weak demand in the latest Spanish auction. There was further speculation over a more dovish ECB policy next week as bank member Nowotny stated that there would be lower inflation in 2012.

There was another warning over the ECB policies from the German Bundesbank as underlying tensions remained high with further reports from the IMF-led mission to Greece that budget targets would be missed.

There was some relief surrounding the latest US ISM manufacturing survey as it fell to 50.6 for August from 50.9 previously. Although this was the lowest figure since 2009, there had been expectations that the figure would drop significantly below the 50 threshold. There was some disappointment over the employment component which was the weakest since November 2009. The Euro did find support on dips to below 1.4250 with reports of sovereign Euro buying at lower levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was again unable to hold above the 77 level against the yen on Thursday and dipped to lows below 76.80, but there was no test of support in the 76.50 area. The US PMI data provided some relief for the dollar even though yield support was still lacking.

The latest Japanese capital spending data was sharply weaker than expected which will maintain fears that underlying investment spending is still weak.

There had been speculation that Okada would be appointed as Finance Minister, but Noda appointed Azumi who has little experience in financial matters. This may dampen immediate speculation over fresh intervention to weaken the yen. The dollar was unable to make any headway on Friday as Asian equity markets stumbled.

Sterling

Sterling was unable to make any impression on the dollar during Thursday and after drifting down to the 1.6220 area, a break of support pushed it sharply lower to the 1.6140 area before correcting higher. Sterling’s decline against the dollar was cushioned to some extent by a weaker Euro as Sterling moved back to near 0.88.

The UK PMI manufacturing index weakened to 49.0 for August from 49.4 previously and this was the lowest reading since June 2009, although there was some relief that the release was not even worse. There will be continuing expectations of a weak economy, especially if there is any deterioration in the services-sector data due early next week.

The Bank of England will keep interest rates at extremely low levels and markets will watch any hints over quantitative easing very closely in the near term.

Swiss franc

The Euro remained under heavy selling pressure against the franc on Thursday and retreated to test support below 1.13. In this environment, the dollar was unable to make any headway and retreated to lows near 0.7925 as the 0.80 support area was broken.

There was renewed defensive support for the Swiss currency as risk appetite deteriorated and there were renewed doubts surrounding the Euro-zone financial sector.

Domestically, the PMI August reading fell to 51.7 from 53.5 while the annual growth in retail sales slowed to 1.9% from 7.4% previously. Evidence of a sharp slowdown will maintain pressure on the National Bank to curb any further franc appreciation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

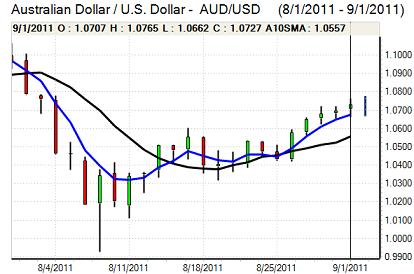

Australian dollar

The Australian dollar found support on dips to below 1.0680 against the US currency on Thursday and rallied to a peak above 1.0760 late in the US session.

Equity markets maintained a firmer tone which initially supported the currency and there was also reduced expectations of any Reserve Bank interest rate cut following relief over this week’s economic data. There was still an important element of caution surrounding the international economy and the currency retreated back to the 1.07 region in Asia on Friday as equity markets were subjected to renewed selling pressure.