Corn may provide a great opportunity for traders looking to grow profits (excuse the bad metaphor)! But TraderPlanet is thrilled to have Cary Artac’s expert technical analysis on the grain markets featured on our site.

SHORT-TERM (TODAY AND 5 DAYS OUT)

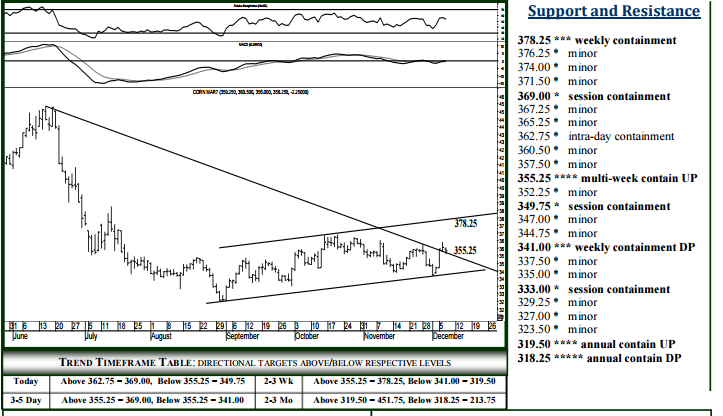

For Thursday, 355.25 can contain selling through the balance of December trade, above which 378.25 remains a 1-2 week target, 404.25 attainable over the next 3-5. Upside today, 362.75 should contain initial strength, while pushing/opening above 362.75 allows 369.00 intraday where the market can place a daily high. Closing today above 369.00 signals 378.25 within several days, able to contain strength through next week and the level to settle above for accelerating the 404.25 target to within 2-3 weeks. Downside today, breaking/opening below 355.25 signals 349.75, while closing today below 355.25 indicates 341.00 within a full week of activity, able to contain selling through next week and a meaningful downside continuation point into later December.

MID (2-3 WKS) AND LONG-TERM (2-3 MO’S)

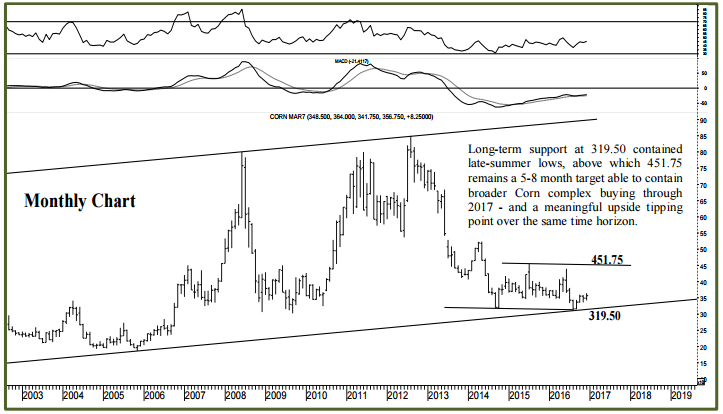

The 355.25 speed-line can absorb selling through the balance of December, above which 378.25 remains a 1-2 week target, 404.25 attainable over the next 3-5 weeks where the market can top out through January trade. Ultimately, the recent settlement above 355.25 does allow 451.75 by contract expiration, longer-term resistance able to contain strength through summer. Downside, closing below 355.25 signals 341.00 within a full week of trade, able to contain weekly selling pressures when tested and the level to settle below for indicating 318.25-319.50 within 2-3 more weeks where the broader complex can bottom out through 2017 and above which 451.75 remains a 5-8 month target (p 2)

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE