The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Friday, May 14, 2010

Hours of daily research consolidated for you

Correlations Corroborating?

For months now, the Golden Sunrise has attempted to shed some light on the relationships that seem to provide some understanding of how the market is moving.

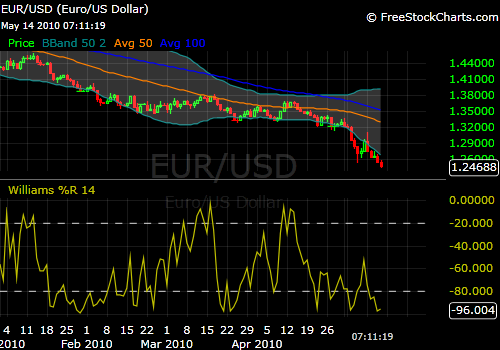

Dollar up-market down has been the pattern. Rising faster now.

Euro down-dollar up…this is from this morning on a 10 minute chart.

Back when the Lehman-crash crash was underway, the key metrics were the Libor, the 3 month Libor and the TED spread. As they went up…dramatically and sharply..like the bounces for Greek debts vs. German Bunds. These short-term interest rates went up and the market went down. Relative to the peak spreads, the current levels are modest-but they have been rising. Small things, perhaps. No charts on this here..can be found on stockcharts.com $libor, $libor3 and $ted.

Euro down, dollar up, gold down..up $18 bucks this morning to $1248. A little pullback yesterday after the sharp run-up-hoped we get a little more. Took more profits in this area. Hate selling these things. Whoa…dollar up, gold up lately. What’s that all about?

Open interest in gold futures were up again, for the 9th day in a row. Open interest has reached 588,106 which I believe is an all-time high. Daily volume has been running 2-3x normal. Price is going up. Buyers are coming in and buying pullbacks.

As I have said many times, I think people should own some physical gold..despite the rise and potential pull-backs, paper gold is the realm of JPM and GS and can be moved with leverage. Physical cannot and there isn’t that much around so there will be a point in can’t be bought. If you think of the hyper-inflations that have taken place throughout history and they all began exactly the same way and follow the same path and procedures please tell me how the situation is different here and what price in any of the hyper-inflated currencies you would have exchanged the real gold you held in your possession. Paper gold, sure. It is a game…real gold is not.

Bull ratio has moved from 56 to 47.7 in the last week-big drop.

Bear ration up to 24.7 from 18-big rise.

This is interesting-the short ratio has declined for 9 straight days so these bounces are not fueled by shorts. The decline may be sell-stops being hit to lock in profits.

US budget deficit was $82.7 billion in April when the tax receipts come in. Ugly

The S&P moved back above the 50dma and reversed under it.

My favorite timesaver listing in IBD had 12 stocks with ratings above 90 and another 9 above 80 on the down list…many with big volume

This could well be leaders breaking down.

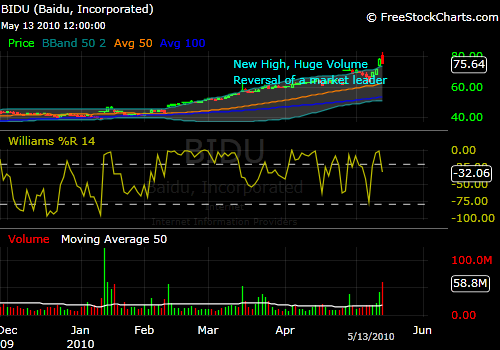

BIDU-daily chart…as one example. Baidu hit a new high yesterday.

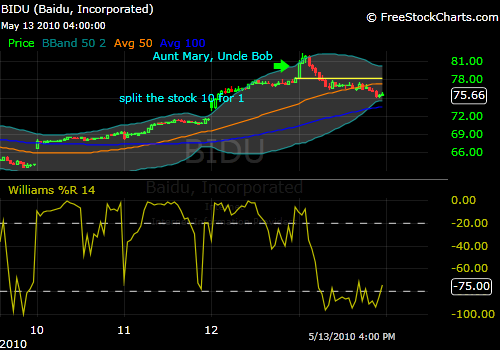

The UncleBob/Aunt Mary syndrome with stock leaders and what happens when you come late to the party. The stock split 10-1.

BIDU on a 15 minute chart. Ugly reversal.

Investors who wouldn’t buy 10 shares at $700 would gladly buy 100 at $70. Big hitters with small sticks.

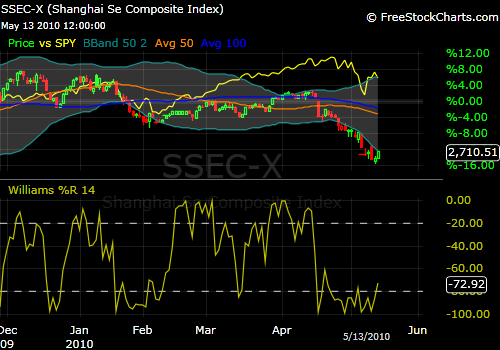

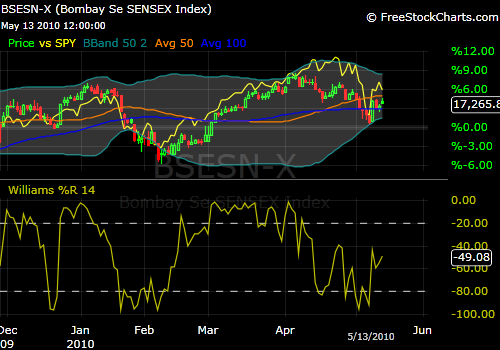

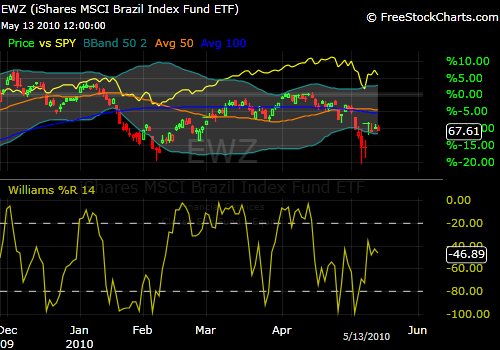

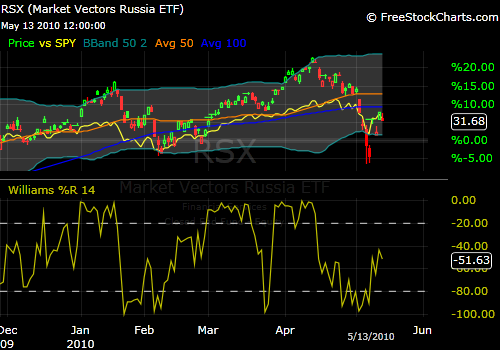

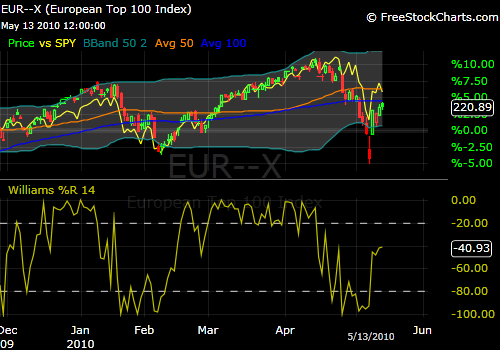

Let’s look at the BRICs-these markets should be leading the world. The yellow line is a comparison with the S&P500. Correlation broken.

India…correlation pretty good..

Brazil..Leading country, heavy commodities…looks lower

Russia..had been the top performing market for several months.. resource rich..huge currency surplus..

European top 100 stocks: strong correlation.

The FTSE-big financial and resources components..companies listed earn most of their revenues outside of the UK..correlated in that sense with the Dow, the NDX, the S&P. This is worth watching.

There is a lot of food for thought here and from it you can draw bullish or bearish conclusions although, without embellishment, it does seem to be indicating a direction.

Watch the markets, watch the charts-the news that is supposed to be moving the indexes is already over by the time we get it.

Own some real gold while you still can.

JohnR

Goldensurveyor.com