Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

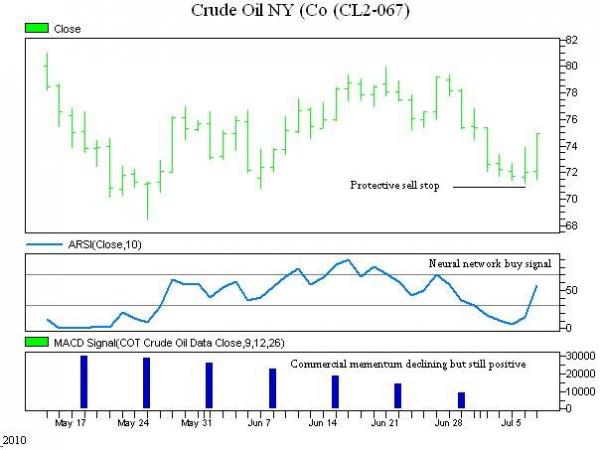

Commercial trader momentum, while still positive, is declining. Perhaps this is due to the fact that crude oil prices tend to peak in late August which corresponds to the Memorial Day weekend holiday traffic.

This is a classic case of accumulation and distribution. It’s quite clear that commercial hedgers were buyers of crude oil between $70 and $78 per barrel throughout the month of May. This was the accumulation stage.

If the pattern holds true, we’ll see commercial hedgers sell off their stock as the market moves back near and through the $80 highs. This is the distribution phase.

Commitment of traders data will most likely show a decline in commercial positions which will be offset by index and small speculator positions as the commercial entities divest themselves of their holdings on the market rally to its seasonal peak.

For more information on this strategy, please call.

Andy Waldock

866-990-0777