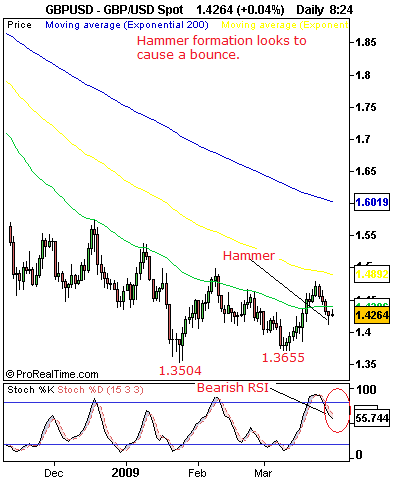

GBPUSD: Downside Pressure With Potential For Corrective Bounce.

GBPUSD: Although a fourth day of downside losses was recorded at the end of Monday trading session, the formation of a hammer candle now suggests that a temporary bottom may be forming. In such a case, a follow through higher on the mentioned hammer must occur to trigger further upmove towards the 1.4305 level, its Mar 06’09 low with a cut through there setting the stage for additional upside gains towards the 1.4662 level, its Feb 23’09 high. Above there must be traded to turn focus to its Jan 16’09/Feb 09’09 highs at 1.4981/86 and possibly higher. On the other hand, while the 1.4662 level remains unbroken, risks exist for price declines towards the 1.3845 level, its Mar 18’09 low and then the 1.3655 level, its Mar 11’09 low .Daily stochastics and RSI remain bearish as well, pointing towards further weakness. All in all, the pair’s current downside weakness remains consistent with its medium to longer term bearish outlook.

Support Comments

1.4137 Feb 12’09 low

1.3845 Mar 18’09 low

1.3655 Mar 11’09 low

Resistance Comments

1.4305 Mar 06’09 high

1.4662 Feb 23’09 high

1.4981/86 Jan 16’09/Feb 09’09 highs

Daily Chart: GBPUSD

This is an excerpt from FXT Technical Strategist Plus, a 7-currency model analysis. Take A One Week Free Trial at www.fxtechstrategy.com

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.