The field of customer relationship management (CRM) software continues to thrive as firms seek an operational edge. Salesforce.com (CRM) is widely regarded as the leader in enterprise software group. It’s setting up again — making a case it wants to go higher — but it’s not my favorite name in the space. That honor goes to Netsuite (N).

A BULL IN THE MAKING

Netsuite has a market capitalization of just over $4 billion. It shows solid growth in recent quarters. Second-quarter profit rose 200% from a year ago to $0.06 a share. Sales increased 29% to $74.7 million. What I really like is that annual earnings growth is really expected to ramp up this year and next. This year, the company is expected to earn $0.22 a share, up 47% from 2011. In 2013, it’s expected to earn $0.35 a share, up 59% from 2012.

NOT A HOUSEHOLD NAME….YET

Perhaps most compelling about Netsuite is that it’s still in the early stages of being discovered by growth fund managers. At the end of the second quarter, 281 funds had a position, up from 212 at the end of the third quarter in 2011. Clearly, there’s plenty of room for more sponsorship, and if Netsuite continues to execute, more funds will embrace it.

BUYER ON HEAVY VOLUME BREAKOUT

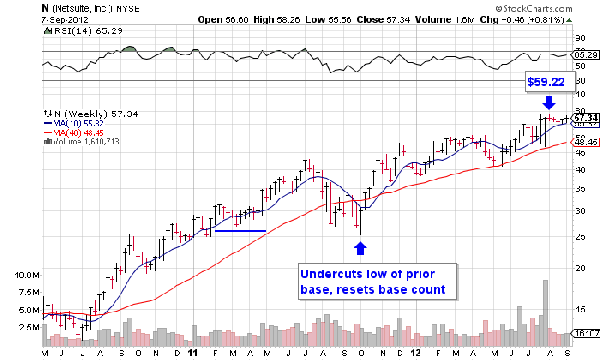

Despite a big price move already, Netsuite’s chart still looks solid. It reset its base count in October when it undercut the low of a prior base. It was a nice shakeout, and it ultimately paved the way for additional price strength. After a technical breakout in late July, Netsuite is firming up at its 10-week moving average. Volume has dried up nicely in recent weeks, something that’s often seen ahead of a breakout.

I would be a buyer on a heavy volume move over its recent high of $59.22.

Looking for more ideas for your Watch List? Read our Markets on the Move  section here.

section here.