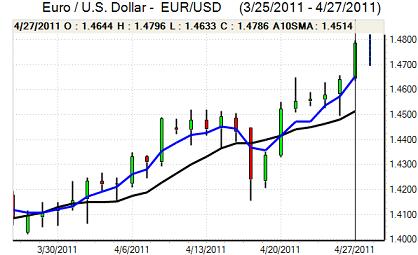

EUR/USD

The dollar secured some respite in European trading on Wednesday as it found support in the 1.47 area, but it was unable to make much headway as underlying sentiment remained extremely weak.

With attention focussed primarily on the Federal meeting a headline 2.5% increase in durable goods orders did not have a significant impact. Interest rates were left on hold following the latest FOMC meeting. It announced that the second phase of quantitative easing would be completed at the end of June and would not be extended. The Fed maintained its stance that interest rates would stay at very low levels for an extended period and that there would be no tapering of the existing programme. In other words, proceeds from maturing bonds will be re-invested to keep the total stimulus constant.

In his press conference, Bernanke stated that the Fed would react to tighten policy if underlying inflation pressures increased, but he repeated previous optimism that the impact of higher food and commodity prices would be transitory.

The Fed’s relatively dovish tone maintained underlying interest in selling the dollar and there was particular disappointment that the only references to the dollar’s value was that the appropriate policies would support the currency in the medium term.

In this environment, the continued widening in Euro-zone yield spreads failed to have a significant market impact even though the yield on benchmark 10-year Greek bonds rose to above the 15% level which increased pressure for a near-term restructuring.

The dollar came under heavy selling pressure following the Fed press conference and the Euro strengthened rapidly to a fresh 16-month high above 1.4850 in Asian trading on Thursday as dollar selling intensified.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to strengthen in European trading on Wednesday and pushed to a high close to 82.70 against the Japanese currency.

Underlying confidence in the Japanese economy remained weak after its credit rating was put on negative watch. The latest economic data continued to register the impact of earthquake damage as there was a very substantial 15.3% decline in industrial production while there was a sharp drop in household spending.

The Bank of Japan maintained a very loose economic policy with no policy changes at the latest policy meeting and there will be further interest in using the yen as a funding currency for carry trades. The dollar failed to gain any additional medium-term yield support from the Fed’s announcement and retreated back to test support below 82 with the yen generally weaker on the crosses as carry-trade interest continued.

Sterling

Sterling weakened in early European trading on Wednesday ahead of the GDP data release with media reports reinforcing market fears that there would be a weaker than expected reading.

In the event, there was a 0.5% GDP increase for the first quarter which was exactly in line with expectations. There was a strong rebound in services activity following the weather-related decline previously, but there was a decline in construction activity which dampened underlying demand.

There was a relief rally in Sterling following the release, but underlying unease over the economy will tend to continue, especially as there was no reported growth in the past six months. The data is unlikely to trigger a significant adjustment in Bank of England interest rate expectations with no increase expected at the May meeting which will limit Sterling support.

Dollar weakness was still the dominant market influence and Sterling strengthened to a high near 1.6750 against the US currency in Asian trading on Thursday.

Swiss franc

The franc lost support on the crosses during Wednesday with the Euro finding support near 1.2750 and rallying to a high near 1.2950 as risk appetite remained firm. In this context, the dollar was able to recover to the 0.88 level against the franc, but it was unable to sustain the gains and wider weakness pushed it back towards record lows in the 0.87 area in Asia on Thursday.

Volatility is likely to remain a key feature with any interest in using the franc as a funding currency will be offset by the risk of capital flight from the Euro area. Friday’s KOF business confidence index will be watched closely to asses whether there has been any negative impact from franc appreciation

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

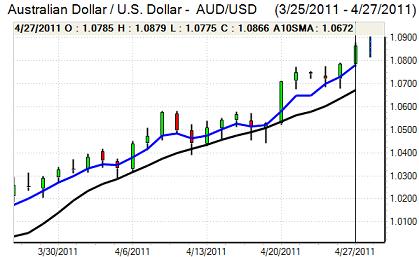

Australian dollar

The Australian dollar retreated cautiously to lows below 1.08 against the dollar in Europe on Wednesday, but selling interest remained limited and there was a fresh surge in demand following the Fed’s interest rate decision with a move to fresh 29-year highs near 1.0950.

The Fed’s commitment to low interest rates will maintain market interest in high-yield currencies and will also sustain demand for carry trades. The Australian currency gained fresh support from an increase in commodity prices as confidence in US assets remained weak.