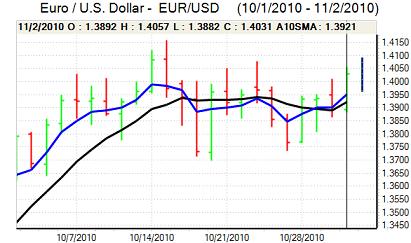

EUR/USD

The dollar failed to secure any fresh support during Tuesday and weakened steadily in US trading with the Euro able to break above the 1.40 level, helped in part by a favourable technical outlook.

There was renewed speculation that the Federal Reserve could adopt a more aggressive policy towards quantitative easing, but the key feature remained a high degree of uncertainty over its intentions. The dollar is likely to be vulnerable to additional selling pressure if there is a commitment in principle to bond purchases above US$600bn.

The tone used by the Fed will also be very important as any potential damage to the US currency would be substantially lower if the FOMC announces that any quantitative easing will be dependent on forthcoming economic data and will not be applied automatically.

The Euro-zone developments have tended to be overshadowed to some extent by the Fed discussion, but will still be very important for market confidence and the currency markets. There was a further widening of yield spreads during Tuesday with Irish bonds falling sharply. Markets have been unsettled by a renewed German push demanding that bondholders would take some of the burden of any future bailouts.

The Euro reaction has been limited so far, but confidence could deteriorate rapidly which would expose the Euro to renewed selling pressure. The Euro peaked near 1.4050 and then retreated back to near 1.40 on a covering of short positions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar resisted a further test of support below 80.50 on Tuesday and pushed to a high near 81, but was unable to sustain the move higher with persistent doubts over the Fed’s intentions continuing to unsettle the US unit.

Trading activity was limited in Asia on Wednesday with Japanese markets closed for a holiday. Immediate direction will inevitably be determined by the Federal Reserve policy action and the US currency will be vulnerable to renewed selling pressure if there is a larger than expected announcement of bond purchases with markets looking to focus on record lows below 80.0.

Markets will also remain on high alert over the potential for Bank of Japan action following the FOMC meeting and volatility levels are liable to be elevated.

Sterling

Sterling was unable to make an attack on resistance in the 1.61 area against the US currency in Europe on Tuesday and initially consolidated above 1.6050.

The construction PMI index was weaker than expected with a decline to an eight-month low of 51.6 from 53.8. This report was in contrast to the firmer than expected manufacturing report and did have a significant impact in unsettling Sterling with a decline to lows below 1.60.

Although there are reduced expectations of near-term Bank of England action to expand the quantitative easing programme, there will inevitably be a sense of nervousness ahead of Thursday’s policy meeting. In this environment, an unwillingness to maintain speculative positions exaggerated the impact of weaker than expected data.

Sterling did find support below 1.60 and was holding just above this level in Asia on Wednesday.

Swiss franc

The dollar was again unable to hold above 0.99 against the Swiss franc on Tuesday and retreated to lows below 0.98 before finding support. The Swiss currency was broadly resilient on the crosses and edged firmer to near 1.3730 against the Euro.

The franc is likely to gain some protection from a renewed widening in Euro-zone bond spreads with some increase in defensive demand for the currency on renewed doubts over the sovereign credit ratings. From a longer-term perspective, there are increased reservations over a potential over-valuation of the franc and this will certainly lessen buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

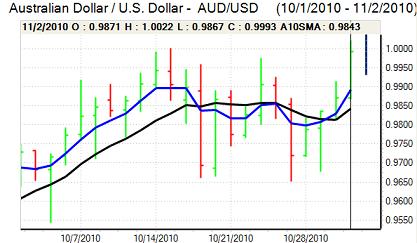

Australian dollar

The Australian dollar continued to attack the 1.00 resistance zone against the US dollar following the unexpected Reserve Bank of Australia interest rate increase on Tuesday. It was unable to make a decisive break above parity, but pullbacks were relatively limited as underlying sentiment remained strong.

The domestic data was mixed with a rise in the services-sector PMI index to above the 50.0 threshold offset by a sharp decline in building permits of 6.6%. There was a slightly more cautious tone on Wednesday with a reduction in speculative positions and this pushed the Australian dollar back to the 0.9965 area.