2013 has not been a good year for emerging markets. While some foreign equities have done well this year, notably Japan and Mexico, others have faltered. To keep an index’s performance in context, I’ll often look at it in relation to another market. We can compare just about anything, an equity market to a commodity, a commodity to an individual stock, a bond ETF to a currency, the list could go on and on.

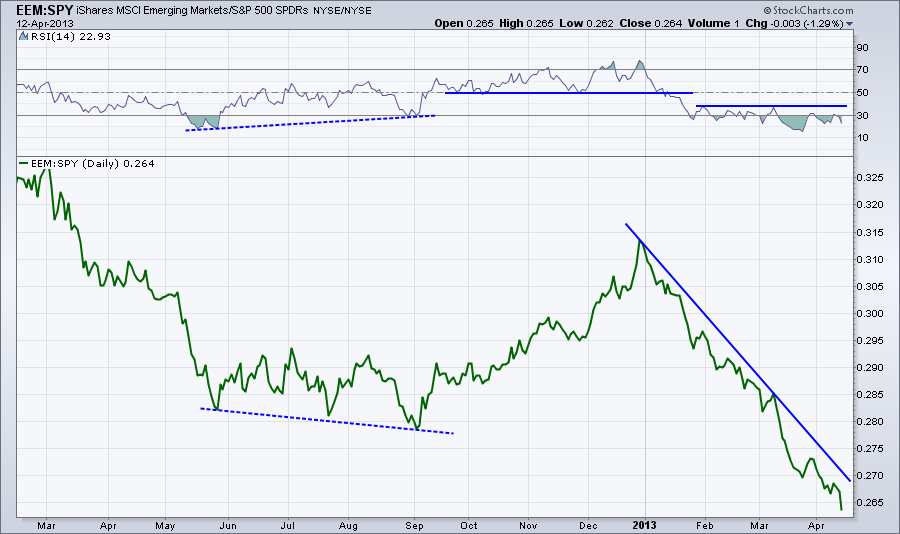

What’s notable for 2013 is the strong outperformance of the S&P 500 (SPY) in relation to MSCI Emerging Markets (EEM). A multi-month divergence was created between the ratio of SPY and EEM and the Relative Strength Index last summer. This helped push emerging market stocks higher into the last quarter of 2012, outpacing U.S. equities. However once we rung in the New Year a shift took place, and the bulls bailed ship from EEM and boarded the S&P 500.

THE CHART

For the last several months we can see the clear downtrend in the green line, indicating that SPY is rising more or falling less than its EEM counterpart. What’s interesting about this domestic outperformance is what’s been happening in momentum.

Take a look back at 2012 when EEM was outpacing SPY. During this time, momentum (based on the RSI indicator) was rising along with the trend of the pair, but still had healthy pullbacks, with 50 acting as support. Then in January, the RSI indicator broke 50 and we had a shift back in favor of SPY. For all of 2013 RSI has stayed oversold, with only two attempts of getting above 40, much less nearing the mid-way point of 50.

BOTTOM LINE

This tells us that the bears have a stronghold on the ratio of these two ETFs. While there have been minor divergences as the ratio makes lower lows and the momentum indicator makes slightly higher lows, the resistance at 40 for RSI, at this point, is what’s important.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.