EUR/USD

The Euro was initially blocked close to 1.3660 on Wednesday and weakened to lows below 1.3620 before finding fresh buying momentum in US trading with a peak above 1.3720.

During the European session, there were reports that Bundesbank head Weber would not seek a second term and would also not be a candidate to succeed Trichet as ECB President later this year. With Weber seen as a fierce anti-inflation hawk, his apparent exclusion as a candidate had a negative Euro impact. There will be further speculation that there will be a more political and unifying candidate which could foster near-term stability, but could also pose longer-term currency risks

The comments from Fed Chairman Bernanke were watched closely, especially as two Regional Fed Presidents had voiced opposition to any further quantitative easing. In congressional testimony, Bernanke stated that economic conditions were improving and that price stability was the Fed’s over-riding objective. He also stated that unemployment was unlikely to return to normal levels for several years which maintained speculation that the Fed would be very slow to tighten policy given its dual mandate of price stability and employment.

There was a more successful 10-year Treasury auction on Wednesday which helped put downward pressure on bond yields and also curbed dollar support as yield trends remained important. The Euro drifted weaker in Asia on Thursday as the currency lacking momentum.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 82.60 against the yen on Wednesday and dipped to lows near 82.20 before finding fresh support. Immediate dollar support was dampened to some extent by a decline in US Treasury yields, although the overall trend was still supportive.

There were further reports of export selling towards the 83 level and there was also evidence of capital repatriation back to Japan which underpinned the yen and also curbed speculative dollar buying.

Domestically, there was a rise in machinery orders for the first time in three months, but the 1.5% gain was lower than expected and confidence in the economy will remain fragile even with the Bank of Japan taking a slightly more optimistic tone. The dollar again tested resistance levels above 82.50 on Thursday as the Euro pushed to a two-week high.

Sterling

Sterling found support just below the 1.6050 level against the dollar on Wednesday and rallied to a high just above 1.6120, but was finding it difficult to make any impression. The UK currency weakened to lows near 0.8530 against the Euro before finding support.

The trade data was weaker than expected with an increase in the goods deficit to a record high of GBP9.2bn. There was a suspicion that the data had been distorted by adverse weather conditions, but the underlying performance will continue to give cause for concern.

Market attention for now is focussed primarily on interest rates with the Bank of England set to announce its interest rate decision later on Thursday. Another two former MPC members called for the MPC to increase rates at this meeting and there has certainly been an increase in external pressure for a move. There will certainly be very important inflation fears, but there will also be expectations that underlying inflation will decline as the economy weakens.

It looks certain that there will be a split vote and a rate hike would certainly not be surprising. Sterling consolidated near 1.61 in Asia on Thursday with small gains against the Euro and volatility is likely to be a key feature later in the session.

Swiss franc

After sharp losses the previous session, the franc found support close to 1.32 against the Euro during Wednesday and edged back to near 1.3130. The dollar was unable to break above 0.9660 and retreated to lows just below 0.9560 in US trading.

ECB developments will be watched closely in the short term and any further evidence that there will be a compromise political appointment as the new President could support the Swiss currency within Europe, although the impact for now should be measured.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

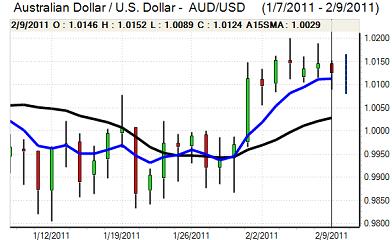

Australian dollar

The Australian dollar found support close to 1.01 against the US dollar during Wednesday, but was unable to move back above the 1.0150 level and drifted weaker later in the session.

Domestically, the headline employment data was stronger than expected with a 24,000 increase in jobs, but there were concerns that the number of full-time jobs declined and the currency was unable to derive any support from the data.

There was a slightly more cautious attitude towards risk and further speculation that Asian central banks would have to tighten monetary policy further to curb inflationary pressures. Commodity prices weakened and the currency continued to drift weaker.