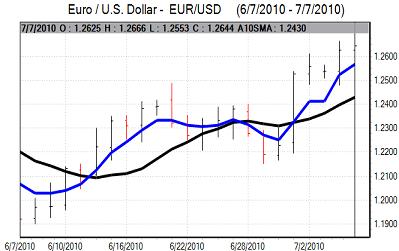

EUR/USD

The Euro drifted slightly weaker in early Europe on Wednesday with lower equity prices curbing buying support. The European banking-sector stress tests were also an important consideration with some unease over the potential outcome and methodology with provisional results likely to be available in around 2 weeks time.

The Euro-zone economic data did not have a significant impact with German industrial orders declining by 0.5% which was the first decline for 2010 following a series of robust gains.

The ECB interest rate decision will be watched closely on Thursday even though rates should be left on hold. There was a growing sense that the central bank would look to take a more optimistic tone surrounding the Euro-zone structural outlook which could also provide some support for the Euro, although confidence will inevitably be very fragile.

There were no US data releases during the day and markets remained concerned over the second-half economic outlook which continued to limit dollar buying support. In this context, the US currency remained dependent on defensive support to make much headway. As Wall Street advanced, demand for the Euro also improved and after resisting a serious test of support the Euro rallied to a high just above 1.2650 during US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Risk appetite remained generally subdued in Asian trading on Wednesday as confidence in the global economy was generally weaker in the face of downbeat data releases. Markets have continued to reduce expectations of higher US interest rates which is undermining dollar support.

There have also been greater doubts over the Australian and New Zealand economies which has curbed interest in carry trades. With regional bourses weaker, the dollar retreated to the 87.35 area with generally narrow ranges during the session as there was some US technical support at lower levels.

The dollar dipped to test support close to 87 during the US session before rallying firmly to 87.75 as higher global equity markets and a resumption of interest in carry trades sapped demand for the yen.

Sterling

Sterling initially maintained a slightly weaker tone on Wednesday, although ranges were narrow in subdued trading conditions. The UK currency found support below 1.51 against the dollar during the day and rallied to re-test resistance levels above 1.52 during the New York session. Sterling benefited from an improvement in global risk appetite with domestic influences of secondary importance during Wednesday.

The Bank of England interest rate decision will inevitably be watched closely on Thursday even though expectations are for rates to be left on hold at 0.50%.

There will be speculation that MPC member Sentence will again vote for an increase in rates and there is a slight chance that there will be majority support for a rate increase. Sterling should retain a firm tone ahead of the decision, but will be subjected to some selling pressure if rates are left on hold.

Swiss franc

The dollar was unable to make any impression on the Swiss franc during Wednesday and weakened to fresh 10-week lows near 1.05 later in the US session. The Euro was also unable to make any headway on the Swiss currency and it retreated to test support close to 1.3280.

The franc was resilient even in the face of improving global risk appetite which suggests that underlying franc demand remains strong as investors continue to fret over the fundamental outlook within the Euro-zone and the US. There will be particular fears that currency devaluation will eventually be a policy option and fears over the outlook will continue to fuel defensive franc demand.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

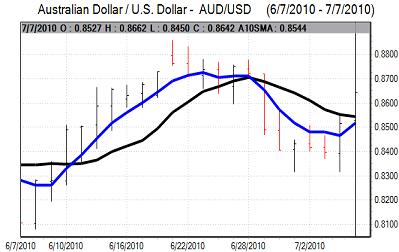

Australian dollar

The Australian dollar found support below 0.8460 against the US currency during European trading on Wednesday and then advanced steadily during the day. Gains accelerated in US trading as there was a rebound in global stock-market prices and renewed demand for carry trades with a peak above 0.8650 with evidence of strong fund support for the currency.

There will still be unease over the global economic outlook and commodity prices have generally been on the defensive which will limit support for the Australian dollar. The latest labour-market data will be watched closely on Thursday and any decline in employment would tend to undermine the currency.