EUR/USD

The Euro found support near 1.4150 against the dollar during Wednesday and advanced strongly during the European session as cross-market trends had an important impact. Euro strength against the Swiss franc also boosted the currency against the dollar and US sentiment remained frail on further evidence of weaker growth.

There were still important stresses within the Euro-zone as peripheral bond yields continued to increase. Spanish yields rose to a high near 6.45% during the day and Italian yields also rose to a high above 6.25% before some moderation later in the day. There were meetings between the Italian authorities and EU Commission to discuss the situation and market nerves were extremely high.

The ECB meeting will be watched very closely on Thursday with comments on the economic outlook, interest rates and peripheral bond purchases extremely important for the Euro outlook.

The ADP employment report was slightly stronger than expected with private-sector employment increasing to 114,000 for July from a revised 145,000 the previous month. There was a rise in the Challenger jobs layoffs according to the latest data and unease over the economy continued.

The ISM index for the services sector dipped to 52.7 for July from 53.3 the previous month, maintaining concerns over the economy. As far as the components were concerned, there was a weak reading for orders and the employment index also weakened over the month which maintained concerns over a potentially weak Friday payroll report.

There was further speculation that the Federal Reserve might move towards further quantitative easing and there were further doubts surrounding the credit-rating outlook. The dollar should still gain defensive support, especially with Libor rates increasing again and the Euro was unable to hold above 1.43.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar fluctuated around the 77 level against the yen during Wednesday with a reluctance to commit funds to the Japanese currency. There was increased speculation over Bank of Japan intervention following the Swiss National Bank move to cut interest rates.

The yen weakened sharply during the Asian session on Thursday as the Finance Ministry confirmed that it had sanctioned intervention through the central bank. Japan acted alone on the intervention, but did consult with other G7 members.

The latest monetary-policy meeting was brought forward 24 hours to Thursday forward with the Bank of Japan leaving interest rates on hold at 0.00-0.10%. The central bank increased the amount of quantitative easing to JPY50trn from JPY40trn and the yen weakened to lows near 79.50 against the US currency.

Sterling

The latest UK PMI services-sector report was stronger than expected with an increase to 55.4 for July from 53.9 the previous month which was the highest reading since March. The data helped ease immediate fears over the economy which provided support for the UK currency.

There was also reduced speculation that the Bank of England would make an early move to sanction any additional quantitative easing which should also provide Sterling support with the latest MPC interest rate decision due on Thursday.

Euro-zone developments also remained an important focus and there will be further defensive support for Sterling if stresses within the Euro area intensify, but market conditions remain very volatile and a further tightening in banking-sector liquidity would be a negative factor for Sterling. Sterling pushed to highs near 1.6440 against the dollar before retreating again with some Euro support near 0.87.

Swiss franc

The Swiss franc weakened sharply in European trading on Wednesday as the National Bank finally took action on the currency. The central bank cut the repo rate to a range of 0.00-0.25% from 0.25% previously, aiming for a rate as close as possible to zero. The bank also added additional liquidity into the market and promised that further measures would be taken if necessary to combat extreme over-valuation of the currency.

From levels near 1.09 against the franc, the Euro rallied strongly to highs above 1.1150 and the dollar also pushed to a peak near 0.78 before edging slightly lower. The franc also weakened on Thursday following Bank of Japan intervention on the yen. There were still major concerns over the Euro-zone outlook which dampened underlying selling pressure on the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

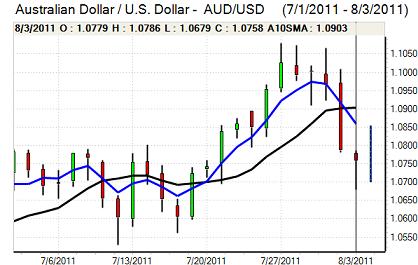

Australian dollar

The Australian dollar found support below 1.07 against the US currency during Wednesday and moved back to the 1.0780 area as risk appetite attempted to stabilise.

There were still fears surrounding the global economic outlook which dampened demand for the Australian currency, especially with the US data again weaker than expected.

There were also still concerns surrounding the domestic economy following a run of weaker than expected data and there was further speculation that the Reserve Bank would move towards an easing bias later this year. The Australian currency was unable to sustain gains as long speculative positions were unwound.