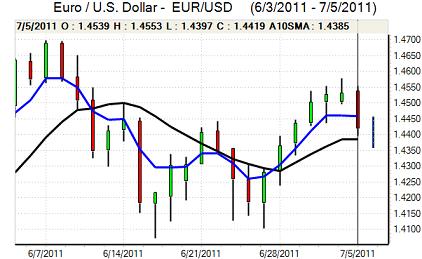

EUR/USD

The Euro was unable to push back above 1.45 against the dollar in European trading on Tuesday and tended to drift weaker in relatively narrow ranges. The economic data did not provide any support with a downward revision to the Euro-zone PMI services-sector data for June while there was a larger than expected decline in retail sales. Both the Italian and Spanish services-sector readings were below 50.0, maintaining fears over the outlook for peripheral economies.

During the US session, the Euro dipped sharply to lows near 1.44 as Moody’s downgraded Portugal’s credit rating to Ba2.

There were informal discussion surrounding plans for private-sector roll-overs of Greek debt and there will be further talks on Wednesday under the auspices of the Institute of International Finance (IIF). Discussions will inevitably be highly technical in nature and an early resolution looks unlikely which will maintain the mood of uncertainty, especially given warnings from rating agencies that any debt extension could be deemed a default.

The ECB will inevitably an important focus on Thursday with strong expectations that the central bank will increase interest rates by a further 0.25% to 1.5%. Comments from Bank president Trichet will be extremely important for Euro sentiment and his comments surrounding Greece will also be extremely important. Crucially, Trichet will need to clarify the ECB stance on accepting Greek bonds as collateral in the event that agencies do call any restructuring a technical default.

The US factory-orders data was slightly weaker than expected and the ISM non-manufacturing data on Wednesday will be important for confidence. Any sharp decline in the index would increase unease over the economy and also trigger a downgrading of payroll expectations while a strong reading would help underpin sentiment. The Euro rallied back to the 1.4460 area with further evidence of sovereign buying, but the dollar should prove to be resilient.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a firm tone during the European session on Tuesday, but was unable to break above the 81.20 area and weakened back towards 80.80 in Asia on Wednesday as the dollar failed to gain any additional yield support

There was further market unease over the Euro-zone debt situation while there increased doubts surrounding the Chinese outlook given conflicting reports on monetary policy and unease over the local-government debt burden. In this environment, there was caution over aggressive capital outflows from Japan which continued to provide some net yen protection.

The US economic data will be watched closely over the next few days and a weak run of releases would put the dollar under fresh selling pressure.

Sterling

Sterling weakened against the dollar ahead of the UK economic data on Tuesday before securing a sharp recovery. The PMI services-sector index edged higher to 53.9 for June from 53.8 previously. Although only slightly stronger than expected, the data did help stem near-term pessimism towards the economy and there was a covering of short positions.

The UK currency also gained technical support after it broke back above 0.90 support against the Euro. From lows close to 1.60, the UK currency rallied to a peak above 1.6120 before fading again.

There will still be expectations of a weak economy over the next few months which will limit any additional support. There is the possibility of Sterling safe-haven support from fears over the Euro-zone outlook, although this will be offset by unease over the UK banking sector.

There will be strong expectations that the Bank of England will leave interest rates on hold at the latest MPC meeting on Thursday and Sterling yield support will remain weak if there is no increase in borrowing costs.

Swiss franc

The dollar was unable to make any impression on resistance levels above 0.85 against the franc on Tuesday and weakened sharply over the day as a whole. After finding initial support near 0.8450, there was renewed selling pressure during New York trading with lows below 0.84. Movements on the crosses continued to have an important impact as the Euro dipped sharply to lows near 1.21 following Portugal’s credit-rating downgrade.

The Swiss currency continued to draw underlying support from fears surrounding the Euro-zone debt profile and financial sector. High volatility is likely to remain an important short-term feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

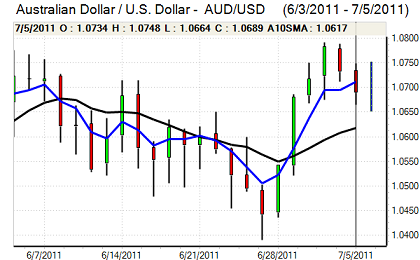

Australian dollar

The Australian dollar found support close to 1.0660 against the US currency following the Reserve Bank interest rate decision and generally proved resilient with a move back to above 1.0720 in Asia on Wednesday.

There were concerns surrounding the Chinese economy which dampened demand for the Australian currency, but there was residual support on yield grounds. The currency also gained some support from a stabilisation in risk appetite and expectations that there would be a stronger employment report in Thursday’s monthly data.