Catch Trend Shifts With MACD Divergences

Identifying market tops and bottoms is considered one of the hardest tasks assigned to a trader. However, the market can hint at these momentum shifts if we take the time to analyze both price action and technical indicators. Today we are going to take a closer look at diverging markets and how they can help attempt price reversals.

What is divergence you ask? Divergence is a market term that describes the separation of price from a directional indicator. While most traders typically use indicators for crossover or oversold levels, divergence traders will wait for the indicator to separate from price. Since indicators are designed to follow price, when a separation occurs it can become a big flag to traders that momentum in the market is potentially turning. So let’s take a look at an example of a diverging market and how it can be used in our trading.

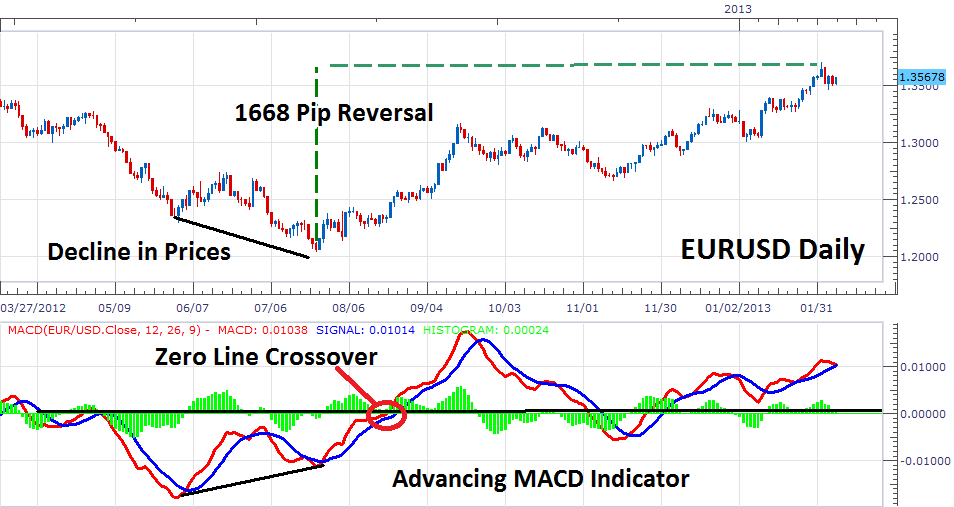

First, to spot divergence, we need to identify a series of lows in a downtrend. We can see this decline in price marked on the chart above by comparing the lows created on June 1and July 24. It is important to note the times when these lows occur as we will need to compare these lows on the MACD indicator. When we look at MACD for the same time frame, the indicator is seen advancing! This separation of price from indicator direction is exactly what we are looking for! The current uptrend in the EURUSD has now surged over 1668 pips since this occurrence.

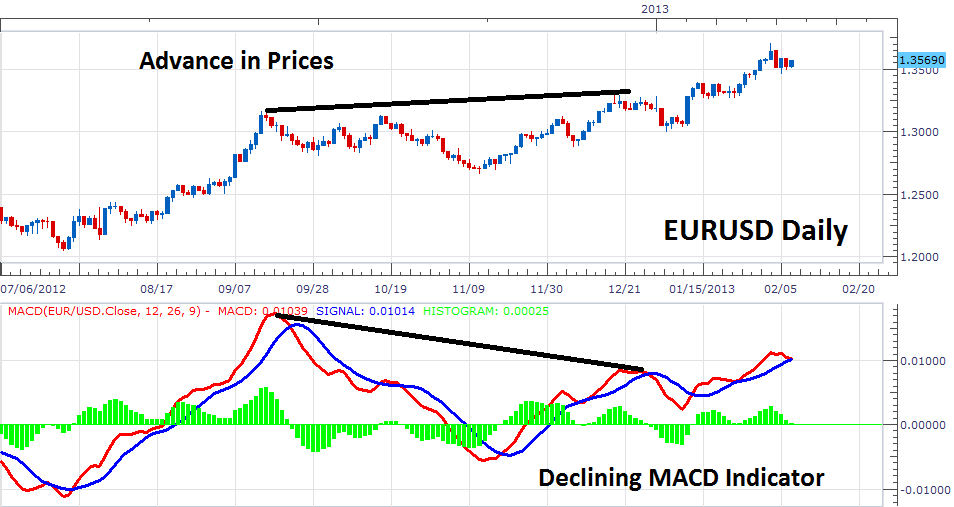

As you can now see divergence can be a very beneficial tool to traders. However, it is important to note that there are challenges when trading divergence signals. Primarily, difficulties can come about when a market remains trending for extended periods of time. When this occurs markets may continue to diverge from their indicator. Below is an excellent example of the current uptrend in the EURUSD. Price has advanced creating a series of higher highs. In turn, MACD has created a series of lower highs which is indicative of a diverging market. As we can see below, despite divergence price is still moving higher on the EURUSD. So how can we avoid trading false divergence signals?

One way to avoid trading a preemptive diverging MACD signal is to incorporate the Zero Line into your analysis. The Zero Line divides the MACD indicator in half and helps us decipher market momentum. Notice in our first chart how after price turns, MACD quickly moves back above our Zero Line. This can be used as a confirmation of our trend shift toward higher highs. Since MACD has not followed through and moved below the Zero Line in our second graph, it is best to avoid this diverging signal as bullish price momentum continues.

Ultimately, divergence is a useful tool in our trader tool box. While it has its limitations, it can be easily worked into any MACD trading system. Being able to catch shifts in the trend can be a huge trading advantage so keep your eyes out for diverging markets!

= = =