October crude oil closed up $0.09 at $72.60 a barrel yesterday. Prices closed near mid-range yesterday. Crude bulls have the near-term technical advantage and this week have gained fresh upside momentum. The next downside price objective for the crude oil bears is to produce a close below solid technical support at $68.00. The next upside price objective for the bulls is producing a close above solid technical resistance at the June high of $75.27 a barrel. First resistance is seen at yesterday’s high of $73.16 and then at $74.00. First support is seen at $72.00 and then at yesterday’s low of $71.66.

Wyckoff’s Market Rating: 7.5.

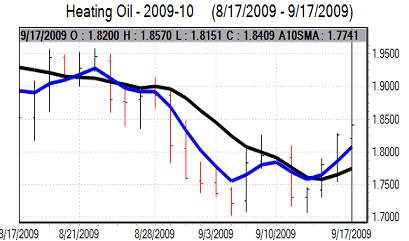

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

October heating oil closed up 162 points at $1.8420 yesterday. Prices closed nearer the session high again yesterday. Bulls have the near-term technical advantage. The bulls’ next upside price objective is closing prices above solid technical resistance at $1.9000. Bears’ next downside price objective is producing a close below solid technical support at the September low of $1.7018. First resistance lies at yesterday’s high of $1.8570 and then at $1.8750. First support is seen at yesterday’s low of $1.8151 and then at $1.8000.

Wyckoff’s Market Rating: 6.5.

October (RBOB) unleaded gasoline closed up 47 points at $1.8530 yesterday. Prices closed near mid-range yesterday. Bulls have the near-term technical advantage. The next upside price objective for the bulls is closing prices above solid technical resistance at the August high of $1.9729. Bears’ next downside price objective is closing prices below solid support at this week’s low of $1.7261. First resistance is seen at yesterday’s high of $1.8731 and then at $1.9000. First support is seen at yesterday’s low of $1.8325 and then at $1.8000.

Wyckoff’s Market Rating: 7.0.

October natural gas closed down 27.9 cents at $3.481 yesterday. Prices closed near the session low yesterday on profit-taking pressure from recent strong gains. Prices hit a fresh five-week high early on yesterday. Bulls faded yesterday and need to show fresh power soon. The next upside price objective for the bulls is closing prices above solid technical resistance at yesterday’s high of $3.90. The next downside price objective for the bears is closing prices below solid technical support at $3.00. First resistance is seen at $3.60 and then at $3.75. First support is seen at yesterday’s low of $3.442 and then at $3.30.

Wyckoff’s Market Rating: 4.0.