Jim Wyckoff, Senior Analyst, TraderPlanet.com

October Crude Oil

October crude oil closed down $1.83 at $100.75 a barrel yesterday. Prices closed near the session lowyesterday and hit another fresh 5.5-month low yesterday. Prices are inching ever closer to major psychological support at $100.00 a barrel. Another major hurricane is bearing down on the Gulf of Mexico oil infrastructure, yet this could not provide support to crude oil yesterday–still one more clue of the bearish psychology of this market. Serious chart damage has been inflicted recently to suggest a major market top was scored in July. The next upside price objective for the crude oil bulls is to produce a close above solid technical resistance at $107.50. The next downside price objective for the bears is producing a close below major psychological support at $100.00 a barrel. First resistance is seen at $102.00 and then at $103.00. First support is seen at yesterday’s low of $100.10 and then at $100.00.

Wyckoff’s Market Rating: 2.5.

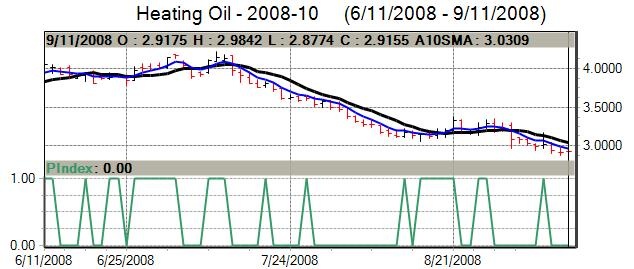

October Heating Oil

October heating oil closed up 112 points at $2.9136 yesterday. Prices closed nearer the session low yesterday. Bears still have the near-term technical advantage. The bulls’ next upside price objective is closing prices above technical resistance at this week’s high of $3.1524. Bears’ next downside price objective is producing a close below solid technical support at $2.8000. First resistance lies at yesterday’s high of $2.9842 and then at 3.0000. First support is seen at this week’s low of $2.8666 and then at $2.8000.

Wyckoff’s Market Rating: 3.0.

October (RBOB) Unleaded Gasoline

October (RBOB) unleaded gasoline closed up 889 points at $2.7505 yesterday. Hurricane Ike did prompt closure of some gasoline refineries and that supported gasoline futures yesterday. Prices closed near mid-rangeyesterday on more short covering in a bear market. The bears still have the near- term technical advantage. The next upside price objective for the bulls is closing prices above solid technical resistance at this week’s high of $2.8380. Bears’ next downside price objective is closing prices below solid support at last week’s low of $2.6082. First resistance is seen at $2.8000 and then at $2.8380. First support is seen at $2.7000 and then at yesterday’s low of $2.6700.

Wyckoff’s Market Rating: 4.0.

October Natural Gas

October natural gas closed down 14.3 cents at $7.25 yesterday. Prices closed near the session low yesterday and scored a bearish “outside day” down on the daily bar chart. Bears remain in firm technical control of nat gas. Hurricanes brewing in the Gulf of Mexico cannot support this market, which shows just how bearish the trading psychology is for natural gas. The next upside price objective for the bulls is closing prices above solid technical resistance at $8.00. The next downside price objective for the bears is closing prices below solid technical support at $7.00. First resistance is seen at this week’s high of $7.705 and then at $8.00. First support is seen at this week’s low of $7.122 and then at $7.000.

Wyckoff’s Market Rating: 1.0.