by Darrell Jobman, Editor-In-Chief TraderPlanet.com

Commentary for September 11, 2008

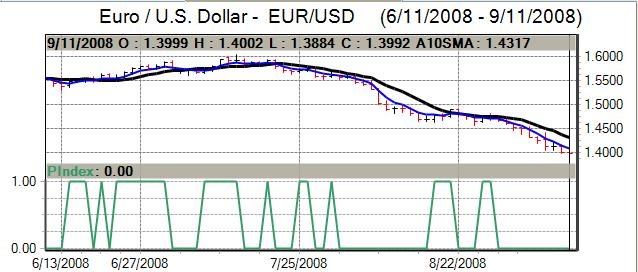

EUR/US$

Yen

Equity prices remained weak in Asia on Thursday with the Nikkei falling by close to 2.0%. This trend maintained the defensive tone in currency markets with a further reduction in carry trades, especially after the New Zealand dollar fell sharply following a 0.50% interest rate cut. Underlying unease over the US and global financial sector also helped support the Japanese currency.

Domestically, there was a 3.9% decline in core machinery orders for July, although this was a slightly lower decline than expected and the impact will be limited with regional and global trends remaining the dominant focus. The yen advanced to 13-month highs below the 150.0 level against the Euro as defensive demand continued.

The trend continued in early US trading with the yen strengthening towards 106 against the dollar and 147.50 against the Euro, but the Japanese currency then lost ground as Wall Street rallied from a weak start. Uncertainty over Lehman was still providing underlying support.

Sterling

Sterling was close to 1.75 against the dollar in early Europe on Thursday while it held firm against the Euro. Inflation expectations edged higher according to the latest Bank of England survey which will maintain unease over underlying inflation trends.

In testimony to the Treasury Select Committee, Bank of England Governor King stated that the prospects for growth have deteriorated while inflation has risen with inflation pressures exacerbated by Sterling weakness. King was also still uneasy over the risk of higher wage inflation.

There were mixed opinions from MPC officials with Blanchflower, for example, repeating his recent warnings that there was liable to be a sharp rise in unemployment. King, overall, suggested that the bank would not rush towards a cut in interest rates which may curb aggressive selling pressure.

Sterling remained on the defensive close to 1.75 against the dollar as the US currency retained strength and failed to sustain gains beyond 0.7925 against the Euro.

Swiss franc

The franc remained on the defensive against the dollar during much of Thursday with lows near 1.1420, but was more resilient against the Euro with a test of resistance towards 1.5820.The Swiss currency continued to secure defensive support as risk appetite remained lower, but it retreated from its best levels as Wall Street rallied. The franc moves are likely to remain strongly correlated with stock market trends in the near term.Markets will also stay on alert for comments from National Bank officials ahead of the quarterly monetary meeting towards the end of next week

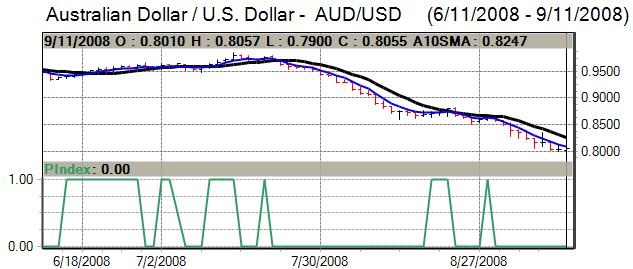

Australian dollar

The Australian currency was undermined initially in local trading on Thursday by a larger than expected 0.50% cut in New Zealand interest rates which reinforced the move away from high-yield currencies.The domestic labour-market data was stronger than expected with a 14,600 increase in employment for August while unemployment fell to 4.1% from 4.4%. The data should stem expectations over an aggressive policy to lower interest rates by the Reserve Bank, although global risk conditions will tend to dominate.The Australian dollar tested levels near 0.79 against the dollar before pushing back towards 0.80 in choppy trading conditions. A sustained recovery will be very difficult without an improvement in underlying risk appetite.