By Darrell Jobman, Editor-in-Chief, TraderPlanet.com

The US banking sector was a continuing and important focus with further fears over the future of investment bank Lehman Brothers. The share price fell sharply and Wall Street also weakened rapidly at times. Speculation that there would be an industry bid increased late in the week and this pulled the dollar from its best levels.

The labour-market data again recorded a higher than expected figure for jobless claims at 445,000 in the latest week from an upwardly-revised 451,000 the previous week which will reinforce fears over the labour market. Retail sales fell 0.3.% in August while core sales fell 0.7% which reinforced fears over the spending trends. Market speculation over a possible move to cut interest rates was again a feature.

The US trade deficit rose to US$62.2bn in July from a revised US$58.8bn the previous month. There was a strong increase in energy imports as volume and prices both rose rapidly over the month. The export performance was still encouraging, although shipments were made when the dollar was trading close to its weakest level.

The ECB continued to warn over the threat of inflation with a particular focus on second-round inflation effects as the central bank looked to stem upward pressure on wage settlements. Bank officials were also very cautious over growth prospects.

The European Commission cut its 2008 GDP growth forecasts and also suggested that the 2009 forecasts would be lowered. There were also reports that the IMF had cut its Euro-zone forecasts and had warned over the recession risk in Germany.

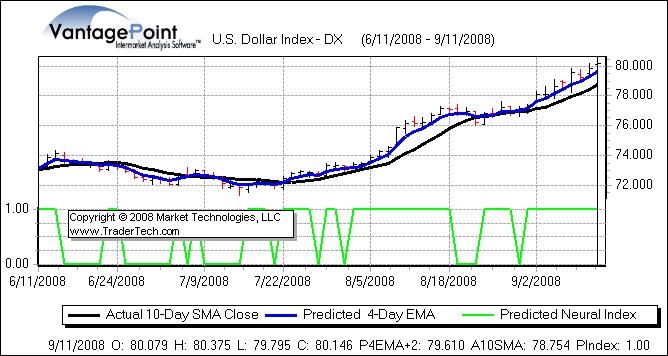

The dollar initially weakened following the rescue with lows beyond 1.44 against the Euro, but then regained ground strongly. The currency pushed to 12-month highs against the Euro below 1.39 and also strengthened to a 1-year high on a trade-weighted basis. The US currency continued to gain support on defensive grounds with a reduction in carry-trade positions and a net flow of funds away from international funds. There was a retreat to 1.41 on Friday on speculation over a Lehman sale and weaker data.

The Japanese currency continued to gain support on defensive grounds with a continuing switch away from carry trades as risk aversion increased. From a peak beyond 148 against the Euro, the yen retreated sharply on Friday as global stock markets and risk indices looked to stabilise.

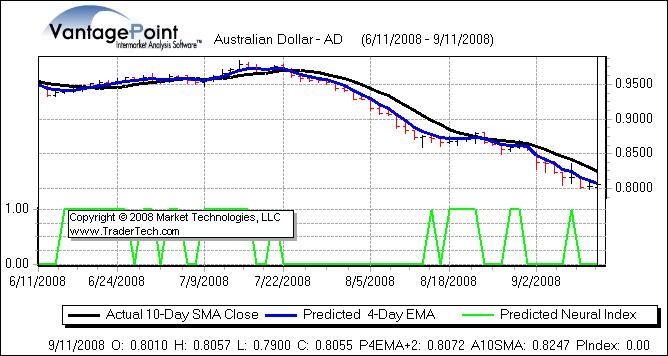

The Australian dollar was subjected to further selling pressure during the week and dipped to 13-month lows against the US dollar at near 0.79 before a corrective recovery back to above the 0.80 level on Friday.

The UK housing-market evidence remained weak with a further 1.8% decline in house prices according to the latest Halifax Survey which pushed the annual decline to over 10%. The RICS also reported a further decline in prices, although the main focus was on the lack of market activity as transactions remained at extremely low levels. The NIESR reported a 0.2% decline in GDP over the three months to August.

Industrial production also fell for the fifth successive month which maintained a lack of confidence in the economy. The UK visible trade account recorded a GBP7.7bn deficit in July from a revised GBP8.0bn previously as the oil account deteriorated.

In testimony to the Treasury Select Committee, Bank of England Governor King stated that the prospects for growth had deteriorated while inflation has risen with inflation pressures exacerbated by Sterling weakness.

There was a variety of opinions and the remarks from Bank of England officials with Blanchflower repeating his recent warnings that unemployment was liable to rise sharply. Overall, King suggested that the bank would not rush towards a cut in rates.

Sterling secured a brief advance against the dollar, but was then subjected to renewed selling pressure and weakened to fresh 30-month lows below 1.75 before a recovery back to 1.77. The UK currency secured a net advance against the Euro and consolidated around 0.7950.