Yesterday

The March contract in the S&P500 mini futures (ESH5) enjoyed a small bounce today as it nears the end of its trading life. The contract closed at 2064.25, up about 25 points on the day. The volume was about 20% of normal. This is about right. The March contract reaches the official rollover day today, and most traders will switch their trading to the new front contract, June. This the last day we will be reporting the March contract results.

ESH5 gapped up at the open Thursday (March 12) and stayed up for the close. This would normally be regarded as a bullish performance, but “this time is different,” to paraphrase a cry heard on Wall Street in every bubble. The combination of the rollover to the new contract and a squeeze on weekly option premiums just ahead of expiration is a more likely explanation for this little bump. We don’t see any change of perspective among traders that would send them suddenly running to the buy side.

The difference between the June contract and March is about 7.5 points (June is lower) and the effective trading price will move lower as the switch to the June contract is completed. If the recent decline is, in fact, over (we doubt it), that won’t be apparent this week. Next week will bring us the inherent volatility of Triple Witching week, when options and index futures expire simultaneously. This might be a good time to stand on the sidelines and shout encouragement to others with more courage or less sense.

Today

This is Friday the Thirteenth, and traders are a superstitious lot, so we may see some participants opting for an early weekend, rather than facing the perils of rollover day. For those who stick around, expect volatility but low volume.

In today’s trading, we may see a dip back down to yesterday’s low area 2046.50 or the Globex low at 2038-39 (long entry), if overnight trading fails to break through the 2066.50 line.

Alternatively we could see a further bounce up to 2070.75-72 zone (short entry) to give call options at 2075 a chance to bail out. In either case, trade with caution. There are likely to be some sudden reversals during the day.

- Major support levels: 2035.50-33.50, 2028-29, 2021-23.50

- Major resistance levels: 2062.50-66.50, 2075-78.50, 2088.75-90.50

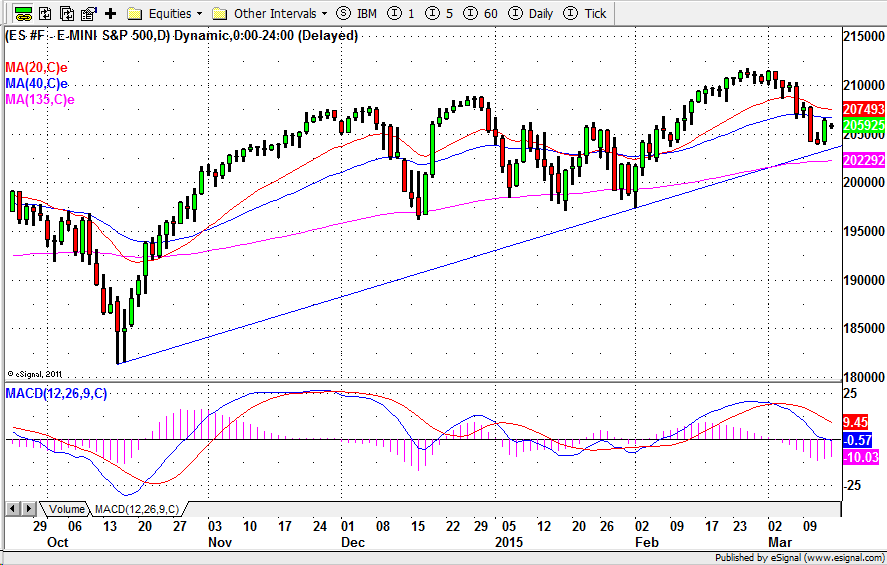

ESH5 Daily Chart, Mar. 12, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.