(Click Image to Enlarge/ Glossary)

(Click Image to Enlarge/ Glossary) The S&P500 (SPY) tacked on another +0.8% gain last week for a four-week increase of +10.0%. Looking at last week’s table above, it is readily apparent how: a) the risk trade has been back on; and, b) how we remain intermediate-term overbought even as very short-term indications have come nearly back to normal.

The S&P500 (SPY) tacked on another +0.8% gain last week for a four-week increase of +10.0%. Looking at last week’s table above, it is readily apparent how: a) the risk trade has been back on; and, b) how we remain intermediate-term overbought even as very short-term indications have come nearly back to normal.

Week Thirty-Two of 2009 features another very busy earnings and economic calendar, including the Friday Job’s report:

- Yahoo! – U.S. Economic Calendar

- Yahoo! – U.S. Earnings Calendar

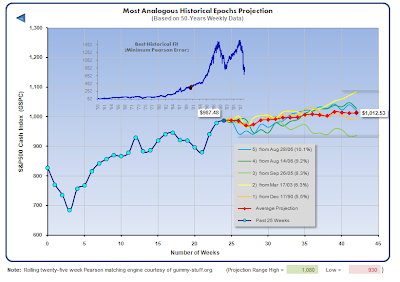

While we remain in this largely abnormal market environment and as a follow-through to the most recent analogous periods prediction, the twenty-week range forecast for the SPX has once again been lifted from lows of 930 to highs of 1,080 (shown below). It’s that March 2003 match that particularly caught my eye. Have a Terrific Weekend!

Never Investment Advice

If you are interested in a significantly more thorough version of this weekly summary, consider taking a look at Market Rewind’s new nightly ETF Rewind Pro service (free trial). In addition to coverage of over 170 ETFs across twelve major asset classes, you will find three model portfolios, daily market signals and commentary, pairs trading and various portfolio management tools.