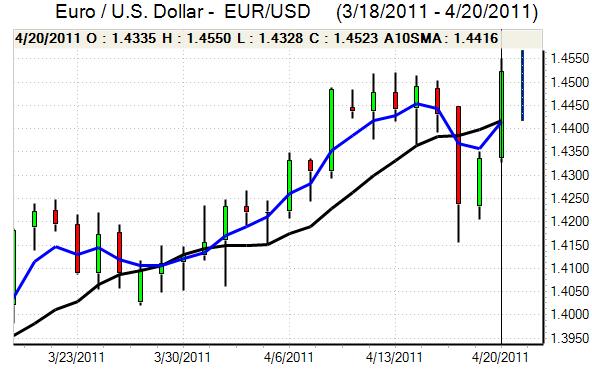

EUR/USD

The Euro continued to push stronger during the European session on Wednesday and made a further attempt on resistance levels. The currency was repelled close to the 1.4550 level and retreated to just below 1.45, but there were renewed gains in Asia on Thursday.

The dollar was also under strong selling pressure against other major currencies and dipped to three-year lows on a trade-weighted basis with the currency close to record lows as sentiment remained weak. Asian central banks continued to intervene to restrain their currencies against the dollar and there was further speculation that these reserves were being diversified away from the US currency.

There was a stronger than expected reading for US existing-home sales for March with an increase in sales to 5.10mn from a revised 4.92mn the previous month, but the market impact was limited as markets remained focussed on underlying yield considerations. There was a renewed surge in demand for high-yield instruments and the dollar was undermined by expectations that the Federal Reserve will maintain a policy of very low interest rates.

There was further upward pressure on Greek debt yields during the day with rumours that there would be a restructuring during the coming weekend. There was, however, some relief surrounding the latest Spanish debt auction which helped underpin the Euro. There were further expectations that the ECB would look to increase interest rates again late in the second quarter which maintained yield support. High volatility is likely to remain the principal short-term market feature with the Euro pushing above 1.46 in late Asia and any G7 comments on exchange rates will need to be watched closely.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any further challenge on resistance above 82.80 against the yen during Wednesday and weakened back to test support near 82.20 late in the US session, primarily reflecting wider dollar weakness as the yen managed to resist further selling pressure on the crosses.

Risk conditions will remain important in the short term and the Japanese currency will tend to lose ground when confidence in the global economy increases and commodity prices rise.

The Chinese exchange rate policies will remain an important focus, especially with some speculation that there will be a one-off yuan revaluation this weekend. Any move to let the Chinese currency strengthen would tend to support the yen, at least in the very short term and the dollar dipped to below 82 in Asian trading.

Sterling

Sterling stalled near 1.6370 against the dollar ahead of Wednesday’s Bank of England minutes and retreated to lows near 1.63 following the release.

In headline terms, the decision was unchanged from the March meeting with 3 members voting for an increase in interest rates and Sentence again called for a 0.50% hike in rates while 6 members voted to rates on hold. There was further concern over the inflation outlook with a warning that the headline rate was set to move above the 5.0% level in the short term, but members were also more concerned over the downside growth risks with a particular focus on consumer spending.

Following the minutes, there was a further scaling back of interest-rate expectations with doubts whether an increase would be sanctioned this year. Sterling will remain vulnerable on yield grounds, especially if there is a weaker than expected retail sales report on Thursday.

Sterling continued to gain some safe-haven support as a refuge from Euro-zone structural weaknesses and a weak dollar. In this context, Sterling pushed to challenge 16-month high near 1.6450 against the US currency.

Swiss franc

The Euro advanced against the franc in European trade on Wednesday with some speculation over corporate buying, although it was unable to break above the 1.30 level. A subdued franc tone on the crosses was not sufficient to support the dollar and it retreated to fresh record lows near 0.8850 before stabilising later in the Asian session.

There will be some reduction in defensive franc demand if there is a sustained improvement in risk appetite, especially if there is a move into high-yield currencies. There will still be reservations over selling the franc aggressively and using it as a funding currency for carry trades, especially given persistent vulnerabilities surrounding the Euro-zone.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

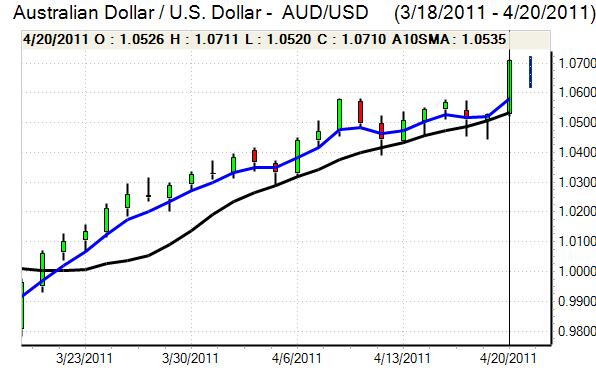

Australian dollar

The Australian dollar resisted profit taking during Wednesday and continued to move steadily high. Buying accelerated from late in the US session and the currency strengthened to a fresh 29-year high above 1.0750 in Asia on Thursday as the dollar came under heavy selling pressure.

The latest producer prices data was slightly above expectations which provided some support, although a move into risk and high-yield currencies was the main driver behind the move. Prime Minister Rudd stated that the government would not manipulate the currency, dampening expectations of currency intervention, but there is still the possibility that the Reserve Bank will curb demand for the Australian dollar by boosting foreign-currency reserves.