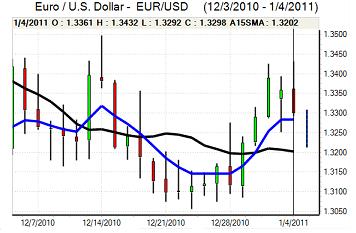

EUR/USD

The Euro strengthened in early New York trading on Tuesday and pushed to a 3-week high just above 1.3420 as the Euro gained significant support on the crosses. The Euro was unable to sustain the gains and weakened sharply to lows below 1.3280 as volatility levels remained high.

There were no major US economic releases during the session with markets still taking a broadly positive attitude on near-term growth trends following a run of generally favourable data. This confidence will be sustained if there is a firm reading for the ISM services-sector index which is due for release later on Wednesday and there will also be cautious optimism surrounding the Friday employment release.

The FOMC minutes from January revealed that there was greater confidence in the economy. Fed members were still not willing to consider changes to the quantitative easing programme and there were comments suggesting that a substantial economic improvement would be needed before any adjustment would be considered. The overall dovish Fed stance will tend to dampen dollar enthusiasm.

The Euro is still being undermined by fears surrounding the structural outlook with fears that market pressures will intensify over the next few weeks. The next test of investor confidence will be the Portuguese bond auctions due later today. A favourable market response would provide some degree of Euro support and it held above 1.3250 in Asia on Wednesday, although confidence is likely to remain very fragile given the medium-term outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to strengthen above 82.20 against the yen during Tuesday and retreated to test support below 81.80 before rallying.

The US Federal Reserve minutes failed to provide any additional support to yields which curbed immediate demand for the US currency. A retreat in commodity currencies also had some impact in supporting the Japanese currency with a closing of carry trades.

Overall confidence in the Japanese economy will remain weak which will curb buying support for the yen, especially with underlying optimism towards US growth trends and the dollar consolidated just above 82 in Asian trading on Wednesday.

Sterling

Sterling found support close to 1.5450 against the US dollar on Tuesday and then rallied strongly during the European session with a high above 1.5620.

The UK PMI manufacturing data was stronger than expected at a 16-year high of 58.3 for December from a revised 57.5 the previous month. Within the data, there was also a record high reading for the inflation component.

Inflation expectations and the impact on the Bank of England will be an extremely important market element in the short term. The consumer inflation rate is already more than 1% above the 2% government target and higher indirect taxes will put further upward pressure on consumer inflation.

Sterling may gain some support from expectations that the Bank of England will need to move closer to monetary tightening, but this confidence could prove to be extremely fragile with Sterling vulnerable to heavy selling if the market perceives that inflation control has been lost.

Sterling held firm against the Euro, but retreated to the 1.5560 area against the dollar as the US currency secured a wider recovery.

Swiss franc

The Swiss currency was subjected to heavy selling pressure during the European session on Tuesday with a rapid retreat to lows near 1.2680 against the Euro while the dollar also advanced to above 0.95.

The franc had advanced strongly in the run-up to the year-end and there has been an important element of unwinding these trades on the first full-trading day of 2011 as volatility remained high. The franc will still tend to attract defensive support given a fundamental lack of confidence in the Euro-zone and the Euro auction outcomes will be watched closely over the next few days.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

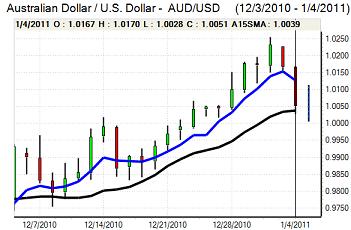

Australian dollar

The Australian dollar found support close to 1.0050 against the US dollar on Tuesday, but was unable to regain the 1.01 level and retreated further to lows near parity in local trading on Wednesday.

After substantial gains during the previous few days, there was a sharp reversal in commodity prices which unsettled the Australian dollar. There was also a decline in confidence surrounding the Australian economy following further downbeat economic data. There was still evidence of solid buying support on dips towards the 1.00 level as market sentiment remained generally strong.