EUR/USD

The Euro maintained a firm tone in European trading on Tuesday as markets looked to challenge resistance levels around and above 1.4250 against the dollar, but it was unable to break into fresh territory. It was vulnerable to a correction after advancing strongly during the past week and risk conditions were slightly less favourable as equity markets stalled with the currency retreating back towards 1.4150.

Euro-zone structural fears also had a negative impact on the currency with initial rumours that an Irish bank had missed a coupon payment which pushed the German-Irish two-year bond spread to record levels. The Portuguese government faces a key budget vote in parliament on Wednesday and defeat for the proposals could trigger a government collapse and increase the risk that Portugal would need immediate access to bailout funds. Markets also remain sensitive to doubts whether European governments will be able to agree terms for expanding the current European stability fund that will remain in place until a larger facility is introduced in 2013.

The Euro still gained support from expectations that the ECB would increase interest rates at the April council meeting and there has been no sign at this stage that the bank is having second thoughts over the tightening.

There were no major US economic data releases and the dollar was still undermined by expectations that the Fed would not tighten policy. Regional Fed President Fisher again voiced his concerns over the current round of quantitative easing and that there was no need for the programme to be extended, but markets will need tougher comments from Chairman Bernanke before sentiment changes.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar again failed to break above the 81.30 area against the yen during Tuesday and drifted weaker to the 80.80 area. The main feature was a narrowing of ranges following recent very high volatility.

There were expectations of G7 intervention if the yen advanced to the 80 area and this discouraged aggressive speculative buying. The Japanese currency did gain support from a slight deterioration in risk conditions and there was also unease over potential capital repatriation back to Japan.

The potential for heavy exporter dollar selling on rallies discouraged US currency buying on existing yield grounds, especially with some renewed doubts over the US housing sector.

Sterling

The latest UK consumer inflation data was again higher than expected with a recorded rise in the headline rate to 4.4% from 4.0% the previous month as food and energy costs continued to rise strongly. The RPI inflation rate also increased to 5.5% from 5.1% which was the highest rate since 1991.

There will be increased pressure on the Bank of England to increase interest rates, especially as the RPI index has an important impact on wage negotiations. There was renewed market speculation over an increase in interest rates at the May MPC meeting which pushed Sterling sharply higher to a high just above 1.64 against the US dollar.

There were also fears that higher costs would undermine demand within the economy and the independent growth forecasts will be watched closely in Wednesday’s budget. Any downgrading would increase unease over the economy’s health and the medium-term fiscal outlook, especially as the February borrowing requirement was higher than expected at GBP10.3bn. Sterling drifted back to the 1.6360 area against the dollar, but maintained a firmer tone against the Euro with markets waiting for further policy clues from Wednesday’s March MPC minutes.

Swiss franc

The dollar found support on retreats towards 0.90 against the franc during Tuesday, but it was unable to make any significant headway during the session as the Swiss currency benefitted from a measured increase in risk aversion.

There was relief over the latest export figures as strong annual growth eased immediate fears over the impact of a sharp deterioration in export competitiveness during the past year. National Bank Chairman Hildebrand stated that upward pressure on the franc should ease, but the Swiss currency will continue to gain support if Euro-zone doubts intensify again.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

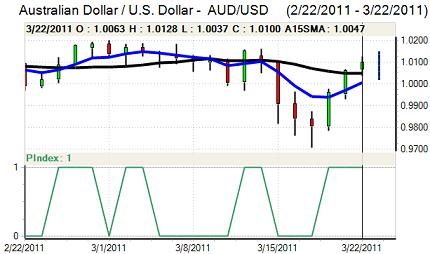

Australian dollar

The Australian dollar was unable to break above resistance in the 1.0125 zone against the US dollar during Tuesday and drifted weaker before weakness in risk appetite pushed the currency to lows near 1.0065. There was still evidence of buying support on dips with the currency gaining solid support on yield grounds.

There was also background support from the high level of commodity prices, especially with the Federal Reserve maintaining very low interest rates, but some reservations that the Chinese economy could slow more rapidly than expected which discouraged aggressive buying of the domestic currency.