“We are what we repeatedly do; excellence, then, is not an act but a habit.”

–Aristotle

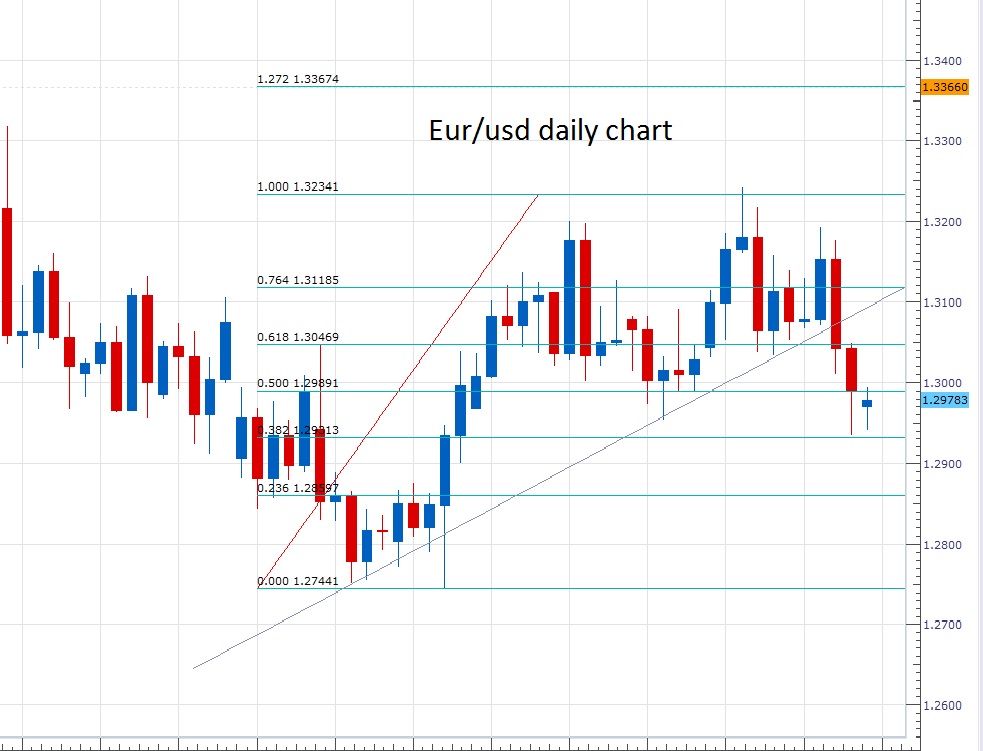

Last week the euro continued its range trading for the first part of the week. As with most trading ideas, the trade set-up I mentioned worked great until it didn’t. Remember, I recommended buying off the highlighted daily trendline. We had several retests of this line early last week and this offered a good opportunity to get long with minimal risk and a defined stop level.

WHAT’S NEXT?

Since the sell-off late last week, the next question is where the euro will go from here. Obviously the short answer is that I don’t know. But the longer answer is an educated guess.

THE ANALYSIS

The selloff on May 9th broke that trendline, continued the next day piercing the 200 day sma and came to rest on the .618 retracement of the daily swing move from 1.275 to 1.324. The real question is if this price action is truly a short breakout of the prior range or if it is just a continuation of the consolidation.

NOT MANY ECONOMIC DRIVERS

Considering this week’s relatively light economic calendar and that last week ended with a 265 pip selloff right to a strong .618 retracement, I think early this week should favor consolidation or a pullback long to prior support resistance zones. If this bottom at 1.293 holds, I would look at buying up to fib retracements of this most recent sell-off.

THE PLAYS

Conversely, as we all know I like trading off levels so look for prior support / resistance on the way up as areas to take light short positions for a few pips. Of course, if this recent bottom at 1.293 gives out, all bets are off until the 1.275 area.