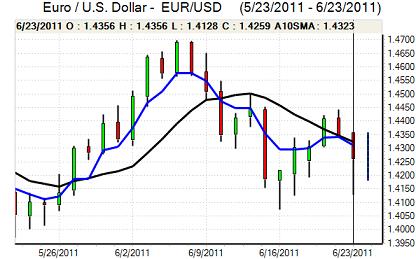

EUR/USD

The Euro was subjected to further selling in Europe on Thursday and pressure accelerated into the New York open with the currency falling sharply to lows below 1.4150. There was an increase in fear surrounding the Euro-zone economy and Euro outlook, especially as confidence in the banking sector deteriorated.

The Euro-zone fears were compounded by a sharp fall in commodity prices as the IEA announced that it would release strategic oil stocks into the market with risk appetite generally weak.

The EU and IMF announced that they had reached agreement with the Greek government over a five-year austerity package. Approval of the package would secure a new EUR120bn rescue package for Greece which would prevent an immediate debt default.

The Euro rallied strongly following the announcement, but there was still a high degree of caution. The government will need to secure parliamentary approval for the measures on Tuesday and agreement is far from guaranteed, especially with the opposition party failing to back tax increases.

Even if a near-term agreement can be reached there will be fears that Greece will still default in the medium term. In the meantime, there will be fears over further underlying capital flight, especially with further weakness in the banking sector.

US jobless claims rose to 429,000 in the latest week from 420,000 previously while the new home sales data was slightly stronger than expected. There was no significant impact on interest rate expectations with markets still expecting the Fed to retain very low interest rates. There was a breakdown in congressional talks over raising the US debt ceiling and there will be a further lack of confidence in the US fundamentals. The Euro rallied to a high around 1.4275 before stalling in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar advanced to a high just above 80.70 against the yen on Friday, but was unable to extend the gains and consolidated near 80.50. Further losses for the US currency were curbed by expectations of strong buying support close to the 80 level.

The yen continued to gain defensive support on the crosses and it pushed to the highest level since March against Sterling with a slide to below 129.0.

There were a flurry of comments from Chinese research institutes suggesting that domestic inflationary pressure had peaked and this tended to improve risk conditions in Asia on Friday with reduced expectations of a near-term increase in interest rates. This lessened immediate demand for the Japanese currency.

Sterling

Sterling remained under pressure against the dollar during Thursday and retreated to fresh 3-month lows below 1.5950 against the US dollar. There was a tentative recovery to the 1.60 area as the dollar lost ground against the Euro.

Underlying confidence in the UK economy and Sterling has continued to weaken following comments on the possibility of further quantitative easing in the June MPC minutes. Although the bank is still likely to be a long way from enacting any further bond buying, references to the possibility have certainly undermined sentiment.

Even if quantitative easing is resisted, interest rates will remain at extremely low levels which will undermine potential yield support.

Thursday’s economic data did not have a substantial impact with a weaker than expected CBI retail survey offset by a slightly higher than expected reading for mortgage approvals. The banking sector will remain an important focus as fears Greek-related losses will continue.

Swiss franc

The dollar was unable to make any impression on the franc during Thursday and it dipped to test support near 0.8380 in very choppy trading conditions. The Swiss currency advanced very sharply to fresh record highs beyond 1.19 against the Euro as Euro-zone confidence deteriorated.

Although the Euro rallied following the announcement of a Greek support package agreement, it was unable to move back above the 1.20 level which suggests that there is still important defensive demand for the franc. Fear is liable to be the dominant influence for now as underlying confidence remains extremely fragile. Volatile trading will remain a key threat in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

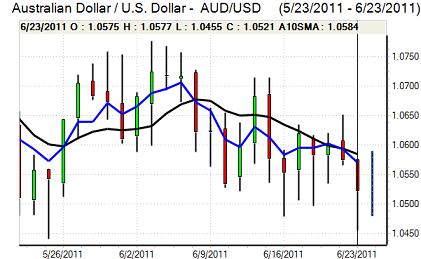

Australian dollar

The Australian dollar weakened sharply in early New York trading on Thursday, dipping to June lows below 1.0460 against the US dollar as risk appetite deteriorated and there was heavy selling of commodity prices following the IEA announcement that it would release strategic oil supplies.

There was a cautious recovery in confidence late in the US session which allowed a move back to above 1.05 with the currency also gaining support from reduced fears over a further near-term Chinese move to increase interest rates further. There was still caution surrounding the domestic economy on expectations of a deterioration in consumer spending.