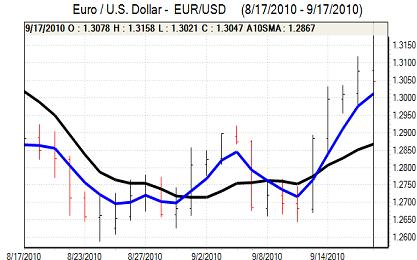

EUR/USD

The Euro maintained a firm tone in early Europe on Friday and pushed to five-week highs above 1.3150 against the dollar as risk appetite remained firm and the US currency remained on the defensive.

The Euro was vulnerable to profit taking after a strong run over the past few days and this made it difficult to extend gains.

During the session, the Euro was also unsettled by renewed stresses within Euro-zone capital markets as there were reports that Ireland would need to seek additional financial support from the IMF. These reports were denied by the Irish authorities, but there was a sustained market impact with the yield spread on Irish bonds widening to a post EMU high. There was also a negative impact on the Euro with renewed concerns over sovereign debt ratings and the risk of major stresses within the banking sector.

The latest US inflation data recorded a CPI increase of 0.3% for August which was in line with expectations while core prices were slightly weaker than expected with no change over the month. The benign core reading will maintain expectations of a loose monetary policy which will continue to limit yield support.

Elsewhere, there was a decline in the University of Michigan consumer confidence index to 66.6 for September from 68.9 previously. The data had some negative impact on risk appetite and also provided some defensive dollar support with the Euro consolidating above 1.30. The FOMC meeting will be important for dollar sentiment over the forthcoming week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support above 85.20 against the yen during Friday and advanced to tackle resistance levels near 86.00.

There was no sign of Bank of Japan intervention during the day, but markets remained very wary over the potential for further yen selling and there was certainly caution over yen buying. Weekend comments from domestic and international financial officials will be watched closely to assess the potential for sustained intervention and G7 support.

In this context, the dollar was able to resist selling pressure despite the weaker than expected US consumer confidence data and it consolidate just above 85.80.

Sterling

Sterling maintained a firm tone in early Europe on Friday and challenged five-week highs above 1.57 against the dollar before hitting profit taking.

Risk appetite was generally weaker during the day as Euro-zone sovereign debt fears returned and this also had some negative impact on the UK currency. As confidence faltered, Sterling weakened to lows near 1.56 against the dollar, but resisted a further test of support near 0.84 against the Euro.

There were no major UK economic data releases and markets will be watching any new survey evidence closely over the next two weeks. There is still an important risk in the UK economy will deteriorate given the risks to consumer spending and investment. The Bank of England minutes due on Wednesday will also be watched closely to assess the central bank intent.

Swiss franc

Volatility remained a key feature for the Swiss currency, maintaining the trend of very sharp moves seen over the past week. After strong gains on Thursday, the Euro was subjected to sharp losses during Friday.

As the Irish rumours undermined confidence in the Euro-zone debt markets, the Euro weakened back to below 1.32 against the Swiss currency. The dollar was unable to break above 1.02 and dipped to below 1.01 in US trading before finding support.

The emergence of fresh stresses within the Euro-zone illustrates that the franc will still attract defensive support at times, although the key feature is likely to remain a high degree of volatility.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

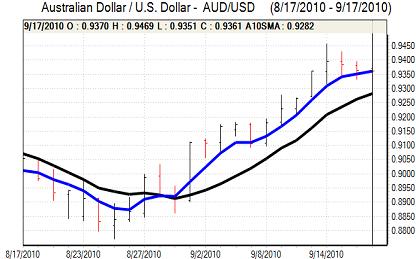

Australian dollar

The Australian dollar pushed to a high above 0.9450 against the US dollar during Asian trading on Friday, but was unable to sustain the advance.

Risk appetite was generally weaker during the day which curbed Australian dollar support and there was also an important element of profit taking after firm gains this week.

Commodity price trends will be watched closely as any further weakening would be a negative factor for the Australian dollar. There will still be solid confidence in the domestic economy which will tend to limit near-term selling pressure on the Australian currency.